Letter For Credit Application A letter of credit or a credit letter is a letter from a bank guaranteeing that a buyer s payment to a seller will be received on time and for the correct amount If the buyer is unable

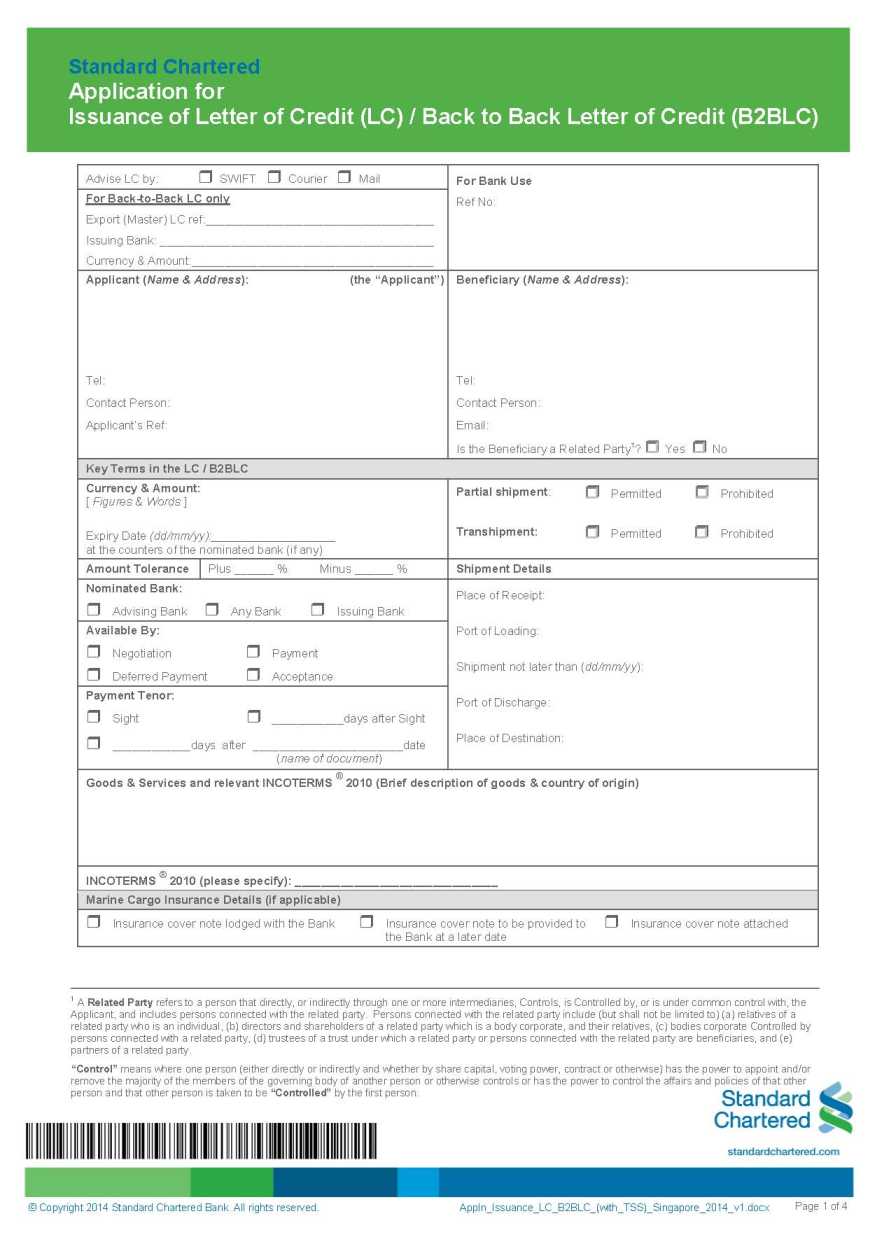

A Letter of Credit LC can be thought of as a guarantee that is backstopped by the Financial Institution that issues it One party is required to guarantee something to another party typically it s payment but not always it could also be guaranteeing that some project will be completed A Letter of Credit is a contractual commitment by the foreign buyer s bank to pay once the exporter ships the goods and presents the required documentation to the exporter s bank as proof As a trade finance tool Letters of Credit are designed to protect both exporters and importers

Letter For Credit Application

Letter For Credit Application

https://images.sampletemplates.com/wp-content/uploads/2017/03/Credit-Application-Approval-Letter.jpg

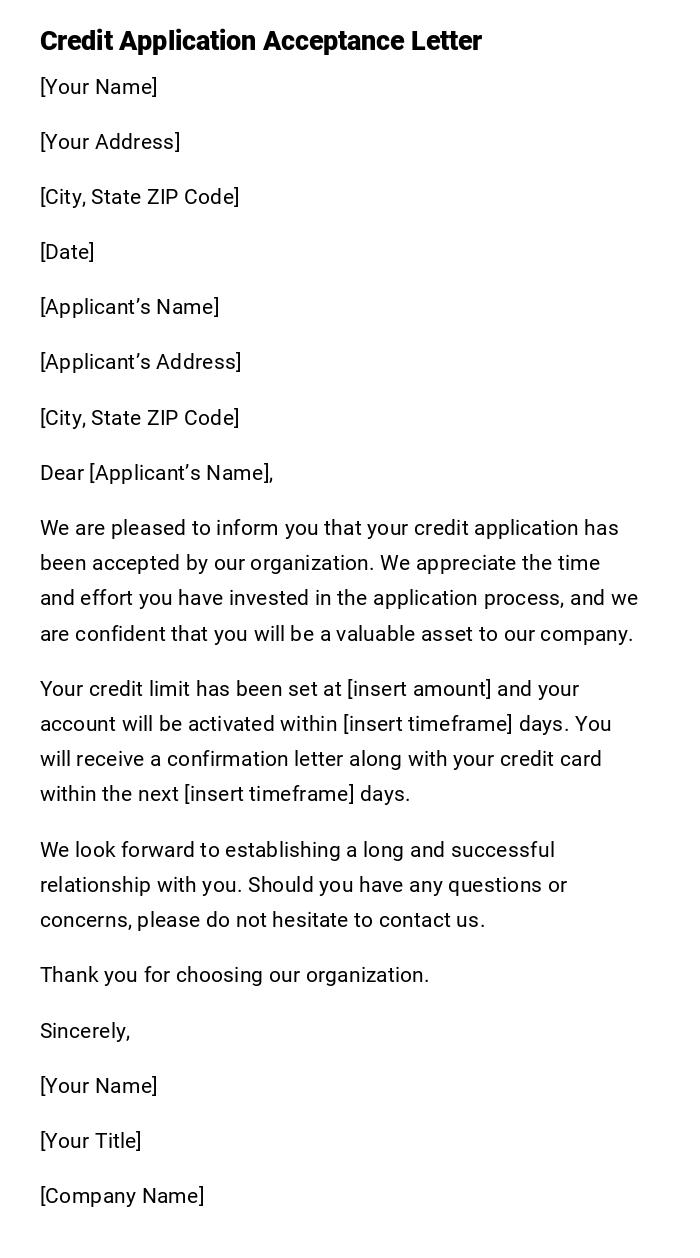

Credit Application Acceptance Letter

https://www.lettersandtemplates.com/letters/photo/credit-application-acceptance-letter/1/credit-application-acceptance-letter.jpg

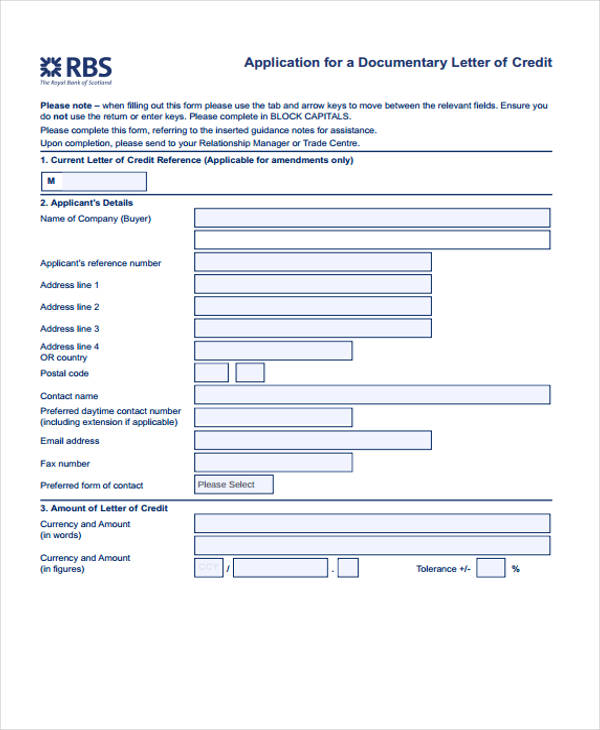

FREE 24 Credit Application Forms In PDF

https://images.sampleforms.com/wp-content/uploads/2017/04/Documentary-Letter-Credit-Application-Form.jpg?width=320

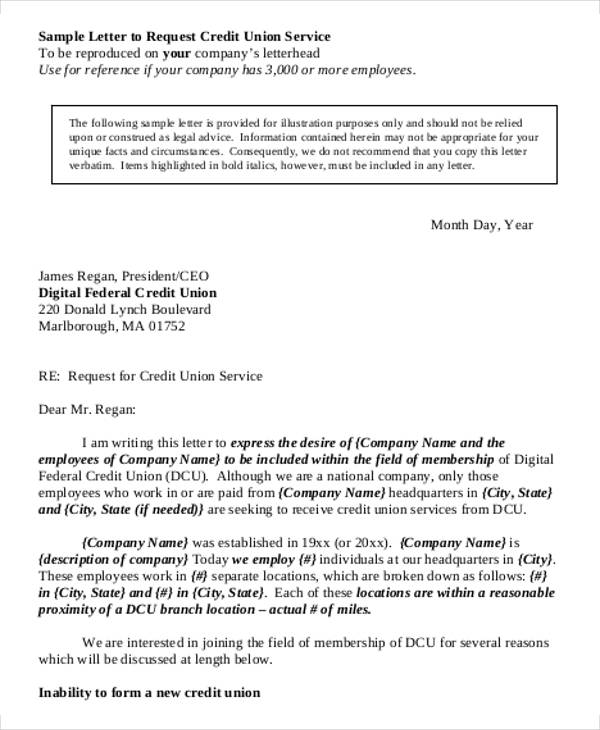

It is important to approach this process with a professional and formal tone to ensure that your request is taken seriously and processed promptly The letter should be well written concise and clearly articulate the reasons why you need the credit account how you intend to use the credit and how you plan to pay it back A letter of credit or credit letter is a bank guarantee that a specific payment will be made As a business owner you may request a letter of credit from a customer to guarantee payment for products or services you re providing

Typically two week processing upon complete Letter of Credit application Fees Fees Call 1 844 807 5060 to learn about the fees associated with a Letter of Credit Call us at 1 844 807 5060 Mon Fri 5 00am 5 00pm PT Wells Fargo Bank N A Member FDIC QSR 04132025 6021922 1 1 A letter of credit provides protection for sellers or buyers Banks issue letters of credit when a business applies for one and the business has the assets or credit to get approved Letters of credit are complicated and it s easy to make an expensive mistake when using one Example

More picture related to Letter For Credit Application

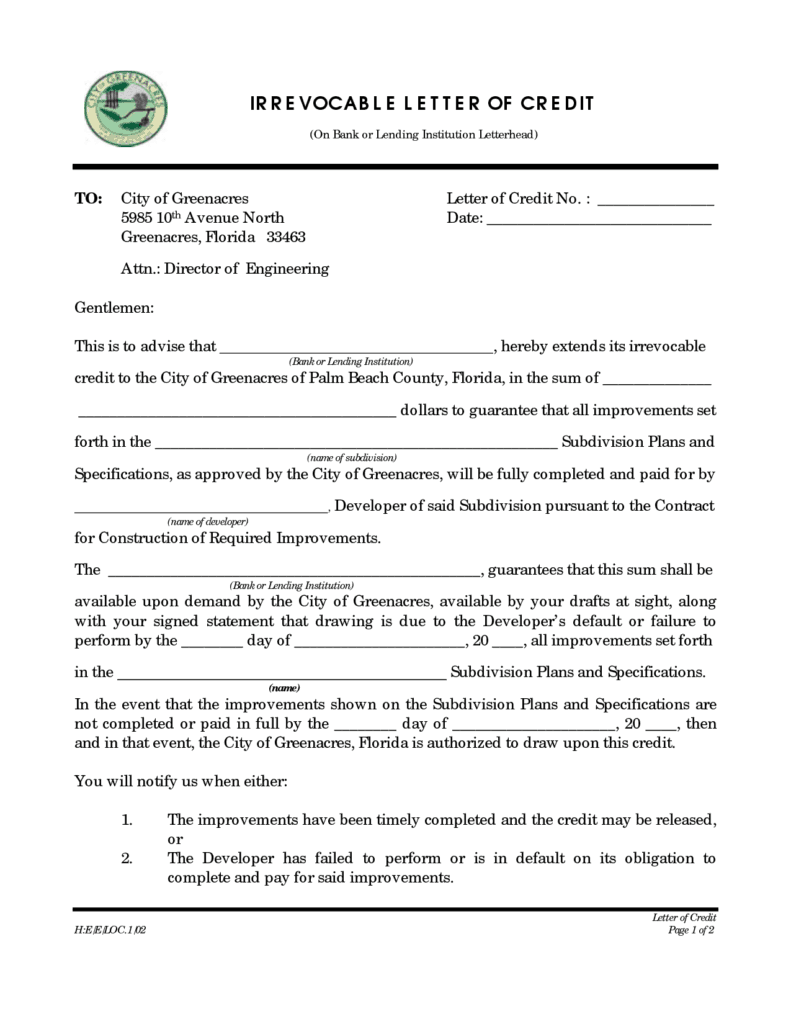

Company Credit Card Approval Letter Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/bf923e53-2b4e-4a93-9e6f-3dff6237d2df_1.png

Standard Chartered Bank Letter Of Credit Application Form 2023 2024

https://eduvark.com/img/j/Standard-Chartered-Bank-Letter-of-Credit-Application-Form-1.jpg

Credit Letter Templates 7 Free PDF Word Google Docs Apple Pages

https://images.template.net/wp-content/uploads/2017/02/27204832/Request-for-Credit-Letter-Template.jpg

A typical fee for a letter of credit is typically 0 75 percent to 1 5 of the amount of the deal but the rate will vary depending on the country and other variables How do you apply for a letter of credit Once the terms of a trade are agreed upon between the buyer and the seller a buyer contacts their bank to request a letter of credit A letter of credit also known as a credit letter is a document from a bank or other financial institution guaranteeing that a specific payment will be made in a business transaction Importantly the process involves an impartial third party in the transaction In a letter of credit the issuing bank affirms that a purchaser in this case a

A credit application letter is a request made to the concerned authority to extend the credit period It can be done orally but it is wise for you to write a letter so that the record is maintained Credit Application Letter Writing Tips As it is a formal letter it has to be simple precise and easy to understand Letter of Credit Application APPLICANT CONTACT INFORMATION Contact Person Name Beneficiary indicate name complete address Company Name Job Title Office Phone Applicant indicate name complete address Cell Phone Fax Advising Bank full name address and SWIFT code Email LETTER OF CREDIT TERMS Payment Terms Incoterm

10 Sample Letter Of Credit Writing Letters Formats Examples

https://www.sampleletterword.com/wp-content/uploads/2016/07/letter-of-credit-100-791x1024.png

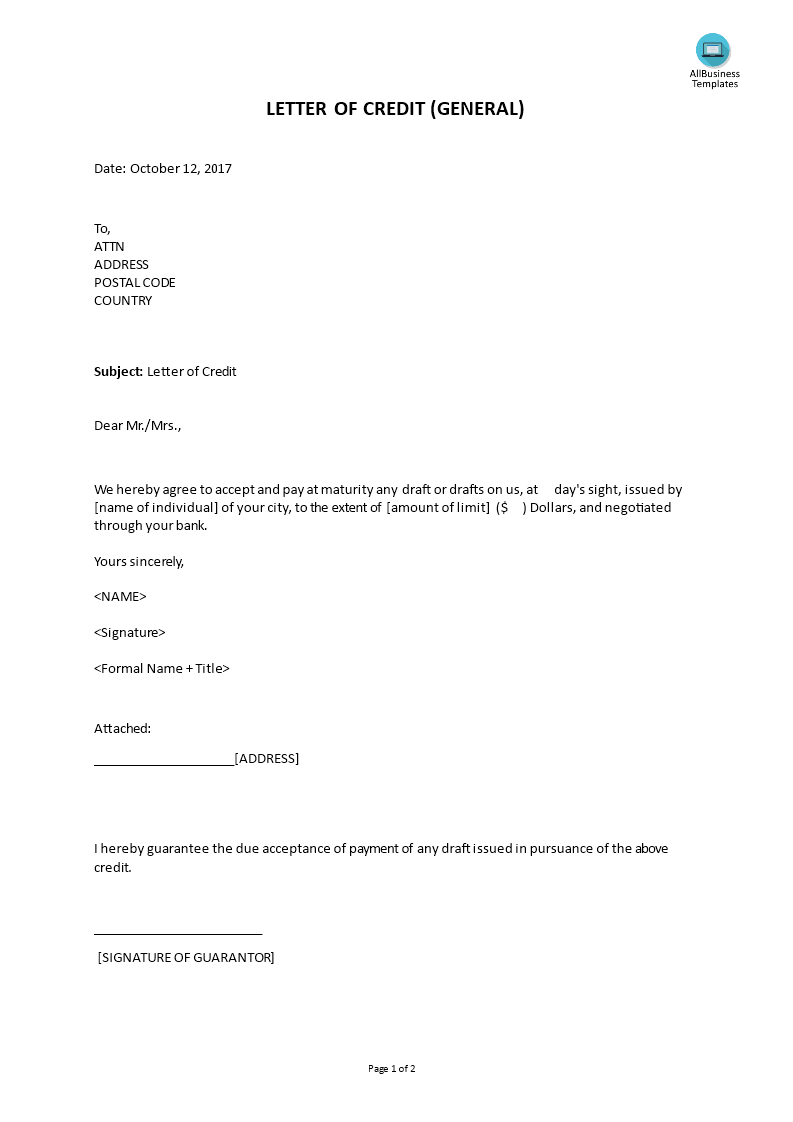

Letter Of Credit Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/a5a45bd0-a977-4de6-bee7-45110ed5e2a9_1.png

Letter For Credit Application - A letter of credit provides protection for sellers or buyers Banks issue letters of credit when a business applies for one and the business has the assets or credit to get approved Letters of credit are complicated and it s easy to make an expensive mistake when using one Example