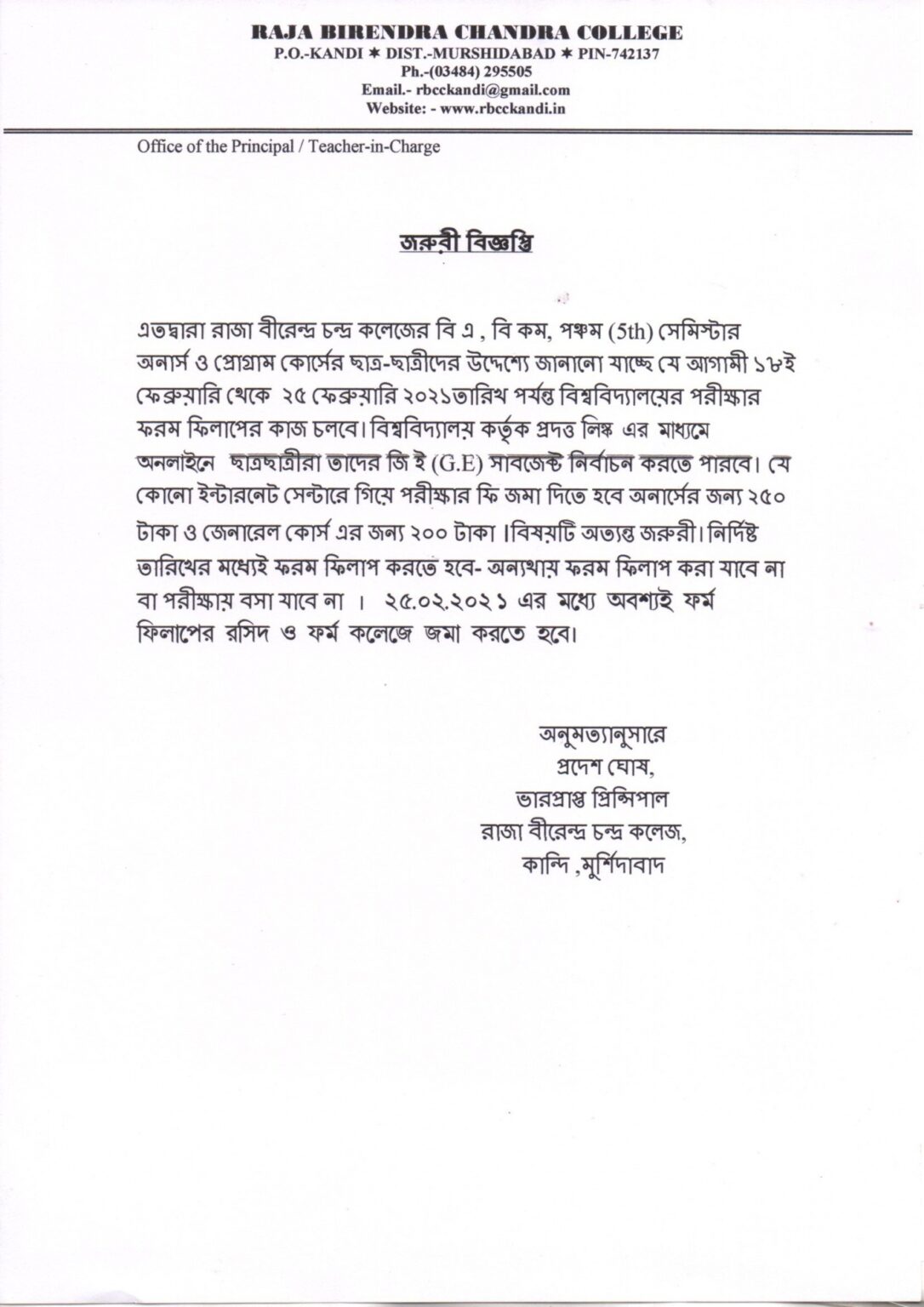

Sample B Notice The law provides that you may be required to withhold a specified percentage see BWH B Rate of certain reportable payments made to recipients payees for whom you filed an information return that had a missing or an incorrect Taxpayer Identification Number TIN

A B Notice is delivered to a filer in the form of an IRS Notice CP2100 or CP2100A Timing can vary but it usually arrives in September or October The notice includes a list of Forms 1099 filed without a TIN or where the name and TIN combination doesn t meet IRS matching criteria This notice will state that the filer may be responsible for Also known as an IRS B Notice the IRS notifies the 1099 filer that a name and taxpayer identification number TIN don t match the IRS database and need correction Failure to comply and rectify the 1099 filing can result in withholdings penalties or audits

Sample B Notice

Sample B Notice

https://tacitproject.org/wp-content/uploads/2022/01/irs-first-b-notice-template-1086x1536.jpg

B Notice The IRS Just Sent Me A 2100 Notice What Now Accounting

https://www.accountingportal.com/wp-content/blogs.dir/13/files/2021/05/firstbnotice.jpg

Notice Of Repossession Letter Template

https://lattermanband.com/wp-content/uploads/2019/02/10-best-of-first-b-notice-template-irs-first-b-of-notice-of-repossession-letter-template.png

First B Notice Sample Published October 13 2012 Updated May 11 2021 First B Notice IMPORTANT TA X NOTICE ACTION IS REQUIRED Backup Withholding Warning We need a Form W 9 from you before Step 1 Identify Which IRS Notice You Received The IRS will send you a CP2100 Notice or a CP2100A Notice if your tax documents contain Missing TINs or Incorrect Name TIN Combinations A Taxpayer Identification Number TIN can be a Social Security Number SSN for an individual Employer Identification Number EIN for a business

First B Notice IMPORTANT TAX NOTICE ACTION IS REQUIRED Backup Withholding Warning We need an IRS Form W 9 from you before Otherwise payment HOLD or withholding will begin Project Task Award Current Name on Account A backup withholding notice sometimes called a B notice states that the nonemployee s taxpayer ID number is either missing or incorrect When you receive the first IRS notice you should follow these steps Send a copy of the B notice to the individual within 15 business days of receiving the first notice and ask them to sign a new W 9 form

More picture related to Sample B Notice

50 Notice Samples Format Examples 2023

https://images.template.net/wp-content/uploads/2021/07/Sample-Waiver-of-Notice-Meeting-of-Incorporators-Template.jpeg

Removal Notice Sample Doc Template PdfFiller

https://www.pdffiller.com/preview/497/333/497333849/large.png

Notice Writing With Examples PDF Examples

https://images.examples.com/wp-content/uploads/2018/03/DAT-AAA_PreFirstDraftNotice_11-11-1.jpg

These notices are commonly referred to as B notices and are generally issued to payers who in the prior year filed Form s 1099 information returns with the IRS Why Are These Notices Received A CP2100 2100A notice is sent to taxpayers that issue Forms 1099 with missing or incorrect taxpayer identification numbers TIN This notice tells you how to help us make your account records accurate and how to avoid backup withholding and the penalty Why Your TIN May Be Considered Incorrect An individual s TIN is his or her social security number SSN

Check that your mailing address is correct and up to date with us so you ll receive your CP2100 or CP 2100A notice We mail these notices to your address of record If you need to update your address please file Form 8822 B Change of Address or Responsible Party Business What is a B Notice i e CP2100 or 972CG A B notice is a backup withholding notice and is sent to a filer of Forms 1099 When a Form 1099 is filed the IRS undergoes a process to match the recipient name and TIN information listed on the Form 1099 they receive with the IRS database

B Notice Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/0/940/940735/large.png

New York Sample 800 7 B Notice Fill Out Sign Online And Download

https://data.templateroller.com/pdf_docs_html/1880/18802/1880273/page_1_thumb_950.png

Sample B Notice - How to fill out the First B Notice word form on the internet To get started on the form use the Fill camp Sign Online button or tick the preview image of the document The advanced tools of the editor will guide you through the editable PDF template Enter your official identification and contact details