Mileage Book For Taxes The mileage deduction is calculated by multiplying your yearly business miles by the IRS s standard mileage rate For 2023 that s 0 655 For 2024 it ll be 0 67 This rate is adjusted for inflation each year It s designed to reflect the average costs of car related expenses such as

The mileage tax deduction rules generally allow you to claim 0 655 per mile in 2023 if you are self employed You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if you re an armed forces reservist qualified performance artist or traveling for charity work or medical reasons 1 Make Sure You Qualify for Mileage Deduction The most common reason for claiming the mileage deduction is travel from the office to a worksite or from the office to a second business related

Mileage Book For Taxes

Mileage Book For Taxes

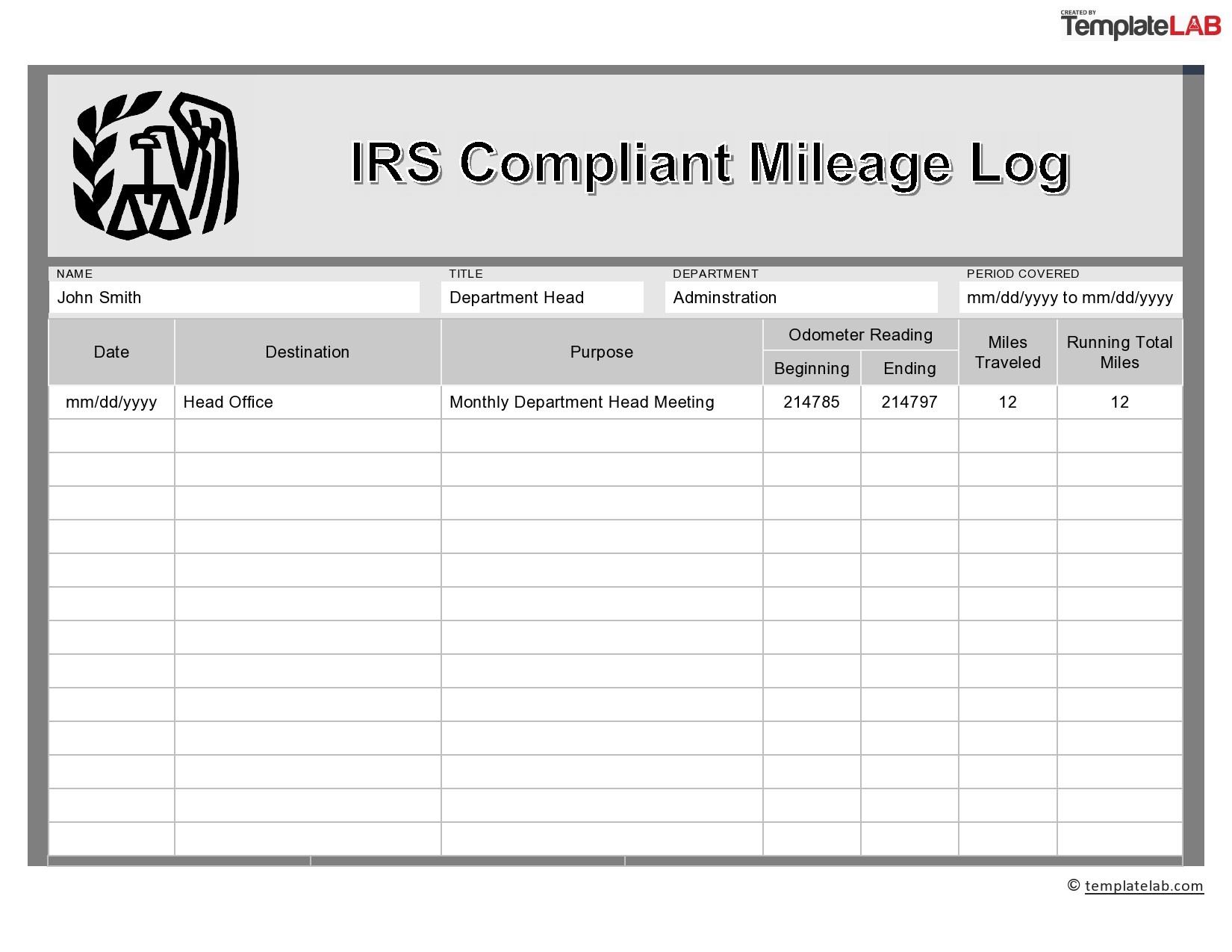

https://templatelab.com/wp-content/uploads/2020/02/IRS-Compliant-Mileage-Log-TemplateLab.com_.jpg

Mileage Log Book Car Tracker Auto Driving Record Books Vehicle

https://i.pinimg.com/originals/93/cf/99/93cf99cc37e9c776e6354800f2d71678.png

Mileage Log Book For Taxes KDP Interior By M9 Design TheHungryJPEG

https://media1.thehungryjpeg.com/thumbs2/ori_4149345_tlesj2m2ldb6okmd4yg28k5pwfkopxb37819ognd_mileage-log-book-for-taxes-kdp-interior.jpg

In 2018 the standard mileage rates increased slightly from those in 2017 for travel related to business medical or moving needs For business miles driven the rate is 54 5 cents per mile For medical and moving mileage the rate is 18 cents per mile And for charitable mileage the rate is the same as the previous year at 14 cents per mile There are two ways to calculate your mileage for your tax return using the standard mileage rate or calculating your actual costs Standard Mileage The standard mileage rate is a simplified way of deducting your mileage It is based on the number of miles driven instead of your actual costs

A mileage log is a spreadsheet or logbook that holds records of the number of miles that you have traveled in your vehicle for business purposes only over a period of time With a mileage log you can use it to claim a tax deduction or reimbursement from your employer What mileage is deductible You can download the printable mileage log template which uses the standard IRS mileage rate for 2024 67 cents per mile for business related driving See an overview of previous mileage rates Important note If you choose to use the Google Sheets version you need to copy the sheet onto your own sheet

More picture related to Mileage Book For Taxes

Mileage Log Book For Taxes Vehicle Mileage Tracker Journal For

https://m.media-amazon.com/images/S/aplus-media/kdp/6578dd7e-2dc0-4c57-b6a2-71fc8e23f794.__CR0,0,970,600_PT0_SX970_V1___.png

Mileage Log Book Car Mileage Tracker For Business And Taxes Paperback

https://i5.walmartimages.com/asr/39571b52-9273-4acd-b893-affda1429e82.7e27b0e8d804ff17f90d667917408c7a.jpeg?odnWidth=1000&odnHeight=1000&odnBg=ffffff

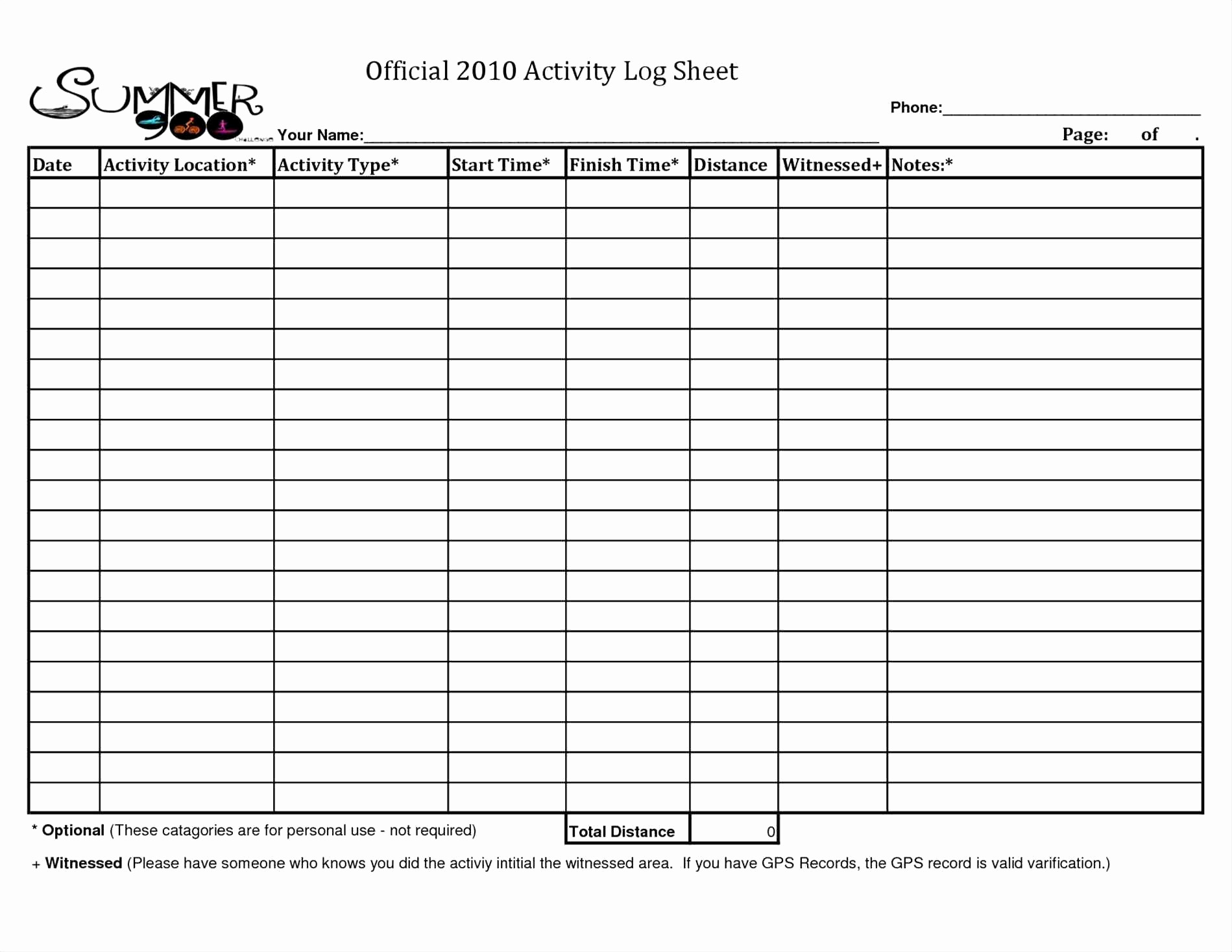

50 Example Mileage Log For Taxes Ufreeonline Template Pertaining To

https://i.pinimg.com/originals/6f/19/40/6f19403e25cb674c1229056aa17c9909.png

For 2023 the IRS standard mileage rates are 0 655 per mile for business 0 22 per mile for medical or moving and 0 14 per mile for charity If you drive for your business or plan to rack up Requirements for the Standard Mileage Rate To qualify to use the standard mileage rate according to the IRS you must meet the following criteria You have to own or lease the vehicle You must not operate more than 5 vehicles This would be considered a fleet Fleet vehicle mileage records are reported differently

California Illinois and Massachusetts require employers to reimburse employees for business mileage Employers can reimburse above or below the standard mileage deduction rate of 65 5 cents per mile If they reimburse below the standard rate the rate cannot be so low as to bring the wage below the state minimum wage For the final 6 months of 2022 the standard mileage rate for business travel will be 62 5 cents per mile up 4 cents from the rate effective at the start of the year The new rate for deductible medical or moving expenses available for active duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate

013 Printable Mileage Log For Taxes With Form Plus Spreadsheet Db

https://db-excel.com/wp-content/uploads/2019/09/013-printable-mileage-log-for-taxes-with-form-plus-spreadsheet.jpg

2020 Mileage Log For Taxes 2020 Mileage Log For Taxes Gas Mileage

https://i5.walmartimages.com/asr/eaca71c7-c042-4167-81e9-62f845dca086_1.0b41048ba750ea795091718da3820109.jpeg?odnWidth=1000&odnHeight=1000&odnBg=ffffff

Mileage Book For Taxes - There are two ways to calculate your mileage for your tax return using the standard mileage rate or calculating your actual costs Standard Mileage The standard mileage rate is a simplified way of deducting your mileage It is based on the number of miles driven instead of your actual costs