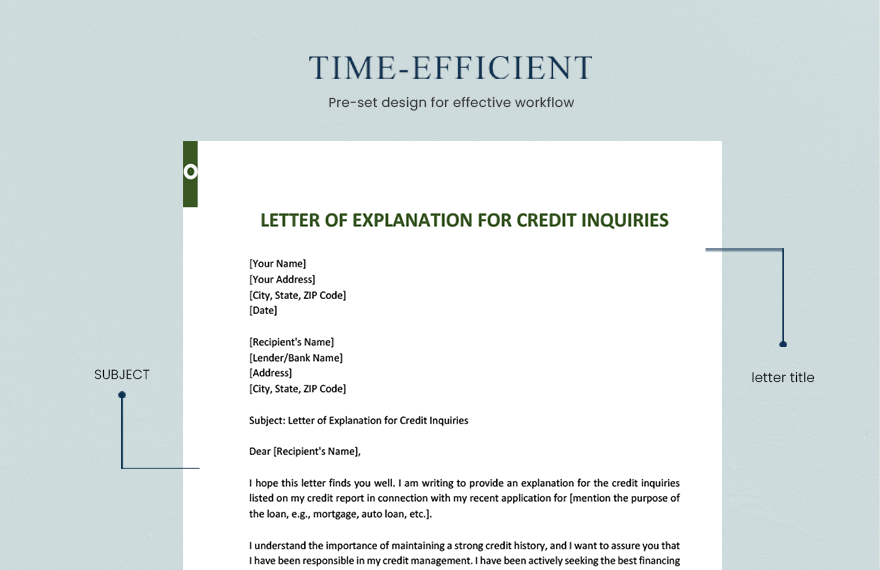

Letter Of Explanation For Credit Inquiries Template What Is a Letter of Explanation A letter of explanation is your chance to answer any questions a lender might have about your loan application This can range from a gap in your

July 20 2021 4 min read Your lender asked for a letter of explanation What now When you apply for a home loan your lender will do a deep dive into your financial history Depending on what The Basics Of Underwriting First it s important to fully understand the mortgage underwriting process During this stage of securing a mortgage the lender decides whether you qualify for a loan by reviewing the financial information you submitted with your application

Letter Of Explanation For Credit Inquiries Template

Letter Of Explanation For Credit Inquiries Template

https://i.pinimg.com/736x/86/d5/10/86d5100ab91d9d1b4b7dde2fb0aa409c.jpg

48 Letters Of Explanation Templates Mortgage Derogatory Credit

http://templatelab.com/wp-content/uploads/2019/01/letter-of-explanation-02.jpg

48 Letters Of Explanation Templates Mortgage Derogatory Credit

https://templatelab.com/wp-content/uploads/2019/01/letter-of-explanation-10.jpg

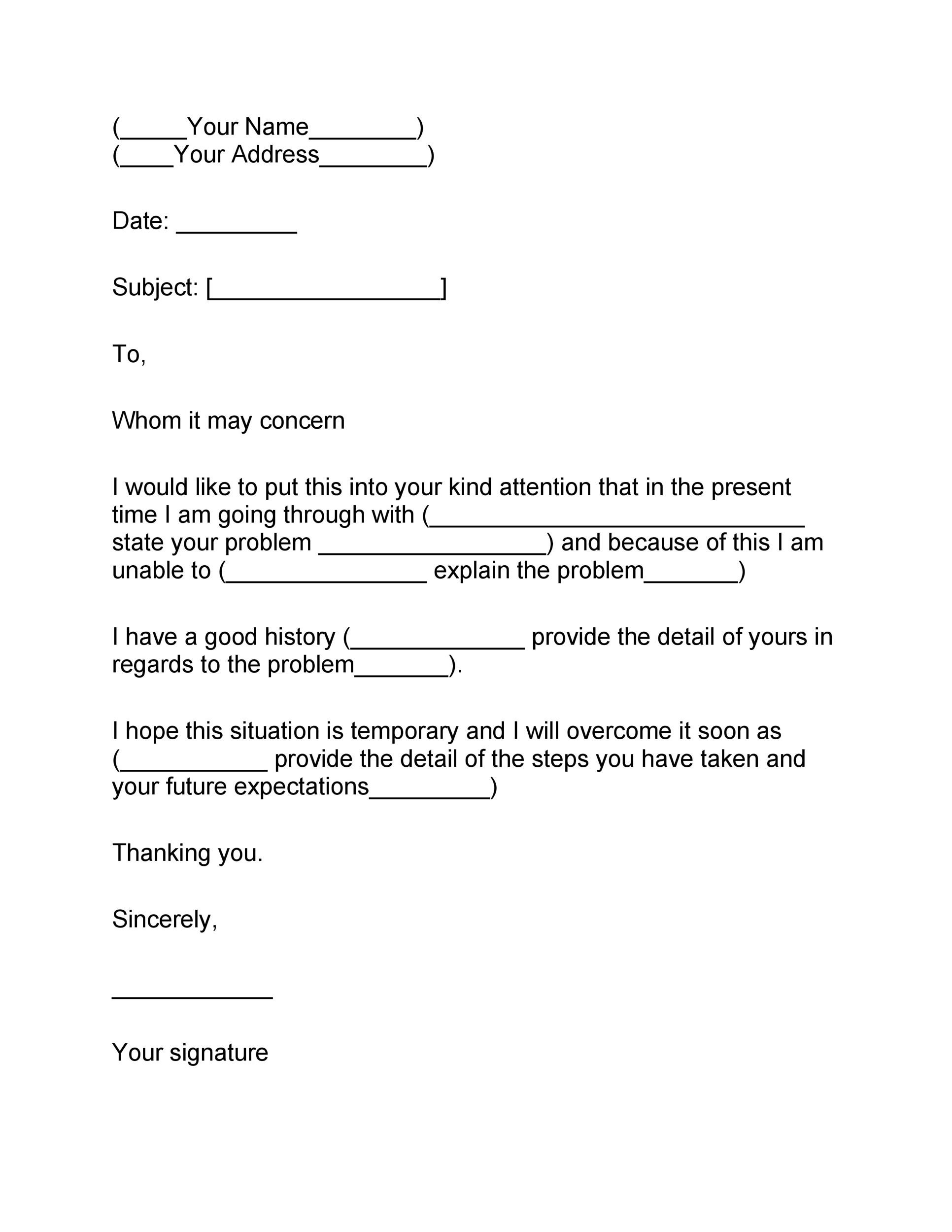

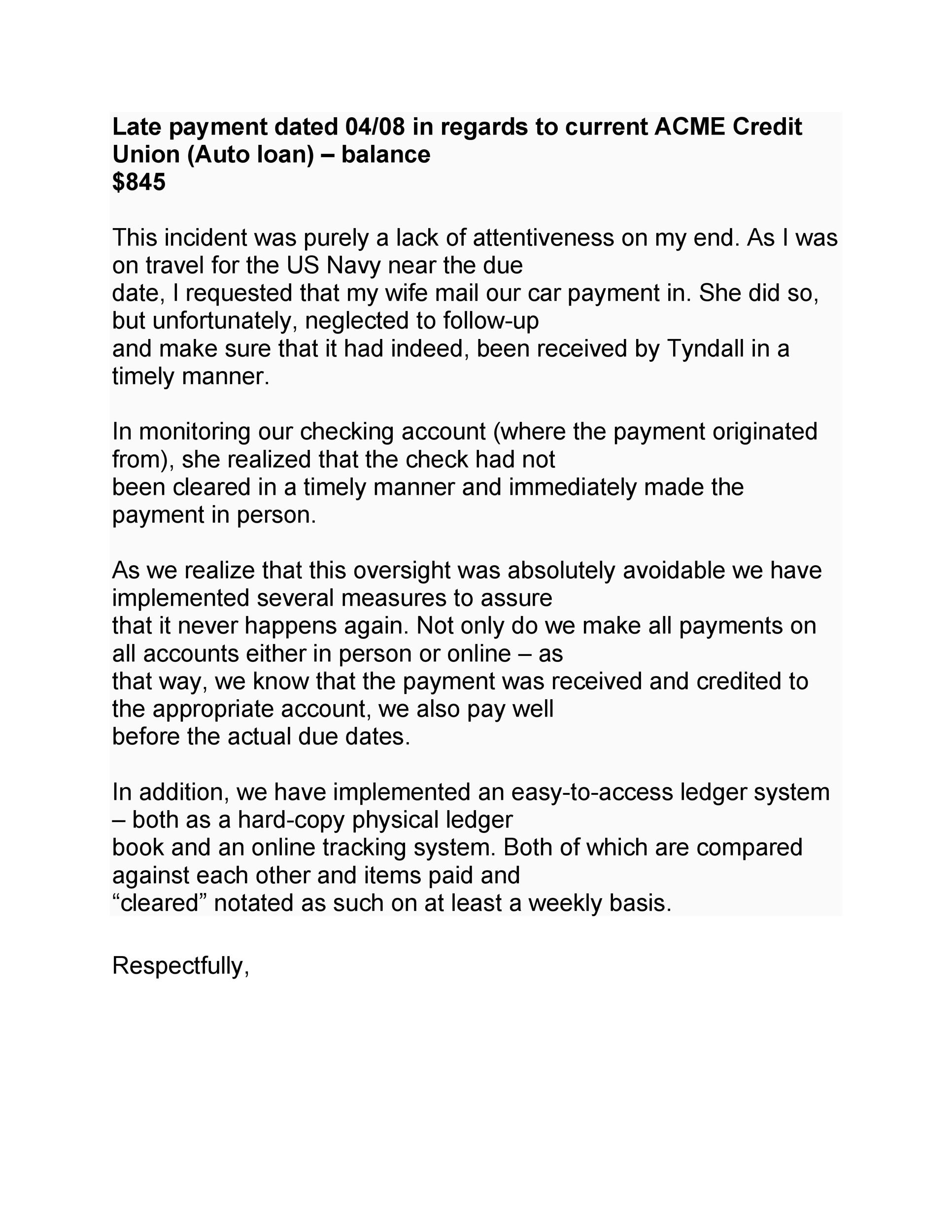

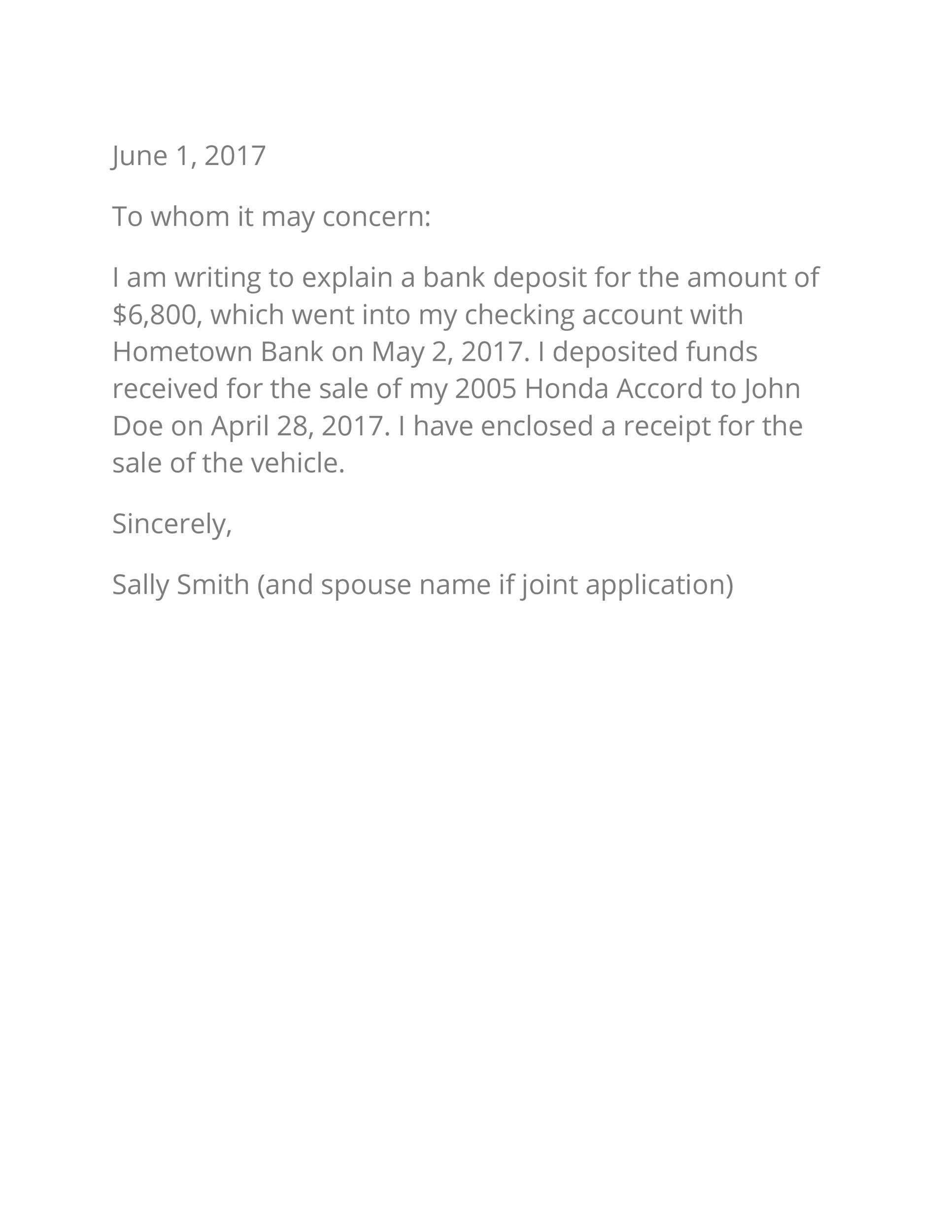

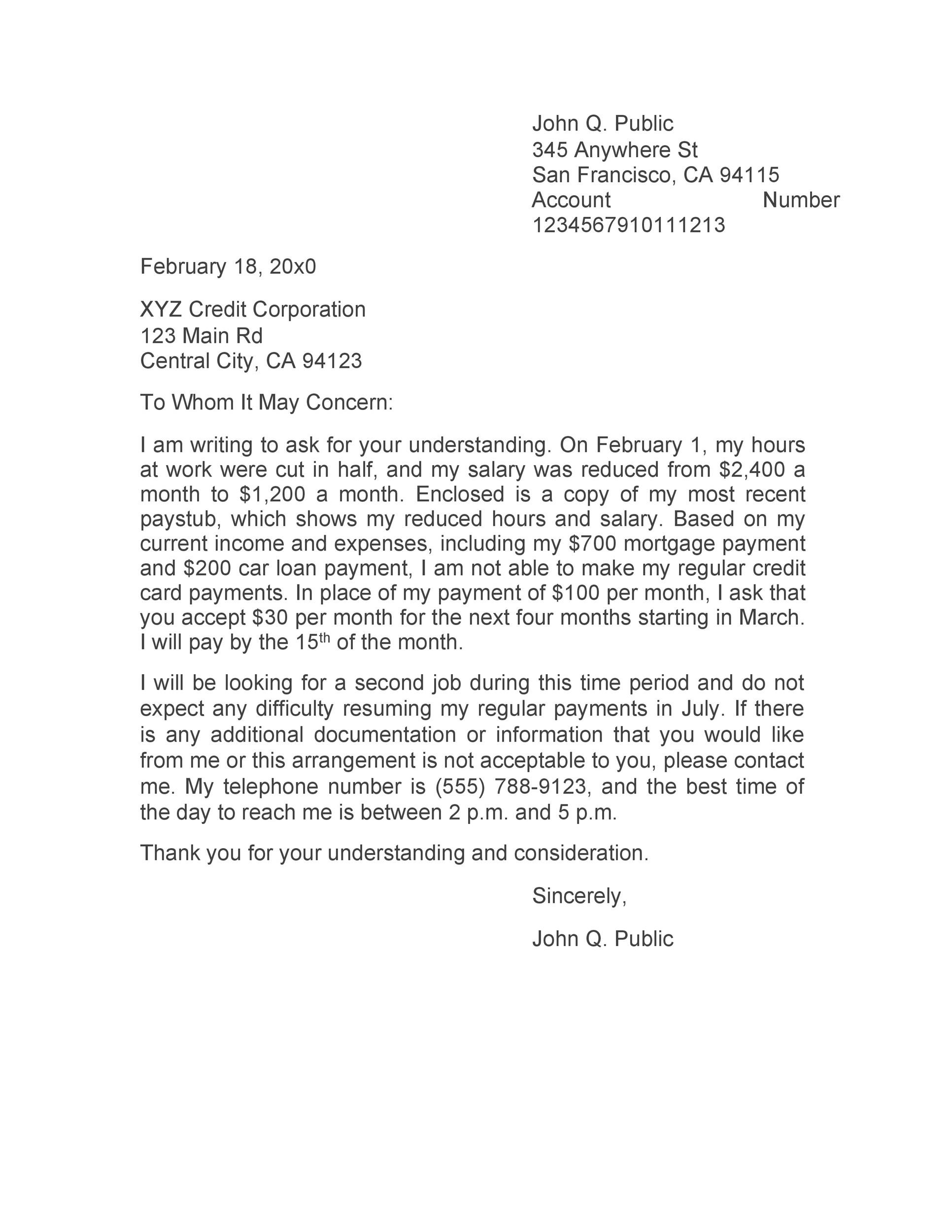

How does a letter of explanation work A letter of explanation is a short document you would send to a recipient such as a lender For instance a lender may ask for a letter of explanation for derogatory credit before he allows you to borrow money A letter of explanation sometimes called an LOE or LOW is a document requested by mortgage lenders when they want more details about your financial situation An underwriter may request a letter of explanation if they run into questions about your finances during the mortgage approval process Why do lenders ask for a letter of explanation

July 1st 2022 Why use LendingTree When a lender asks for a letter of explanation there s no need to panic more than likely the lender just needs your help to clear up in writing something about your credit earnings or assets Date This letter is to address all credit inquiries reporting on my credit report in the past 120 days Creditor Name Date Pulled Reason the Inquiry was pulled Indicate whether this inquiry resulted in an account being opened or will be opened Creditor Name Date Pulled

More picture related to Letter Of Explanation For Credit Inquiries Template

Letter Of Explanation Template

http://templatelab.com/wp-content/uploads/2019/01/letter-of-explanation-05.jpg

Free Letter Of Explanation For Credit Inquiries Download In Word

https://images.template.net/141030/letter-of-explanation-for-credit-inquiries-4lsji.png

48 Letters Of Explanation Templates Mortgage Derogatory Credit

https://templatelab.com/wp-content/uploads/2019/01/letter-of-explanation-46.jpg?w=395

Excessive credit inquiries can also be a red flag and could make the lender suspect you ve been shopping for credit because you ve had trouble getting approved Letter of explanation template The content of your letter will of course depend on your specific circumstances You can use the following sample letter and replace the Free letter of explanation template FAQ What is a letter of explanation A mortgage underwriter may request a letter of explanation to get additional details about your financial situation During the home buying process an underwriter will go through your finances with a fine tooth comb

When addressing credit inquiries specify the purpose such as Shopping for a mortgage or Seeking better interest rates If multiple inquiries exist explain the intent for each If the underwriter finds the explanation insufficient they may request a more detailed Letter of Explanations Letter of Explanation for Credit Inquiries How to Write One Lenders may request a Letter of Explanation for credit inquiries when applying for a mortgage to assess creditworthiness Differentiate between soft inquiries do not affect credit score and hard inquiries can impact credit score temporarily

Credit Inquiry Letter Of Explanation Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/63/864/63864189/large.png

Letter Of Explanation For Credit Inquiries Template Awesome Letter

https://i.pinimg.com/736x/b1/f6/11/b1f611c78c4771850282082b3ac39cce.jpg

Letter Of Explanation For Credit Inquiries Template - July 1st 2022 Why use LendingTree When a lender asks for a letter of explanation there s no need to panic more than likely the lender just needs your help to clear up in writing something about your credit earnings or assets