Letter Of Explanation For Buying Second Home Sample Home Purchase Cash out Refinance NMLS 3030 What Is A Letter Of Explanation A letter of explanation is a brief document you can use to explain something like a previous bankruptcy in your financial or employment history that might give an underwriter pause about your ability to repay a loan

What Is a Letter of Explanation A letter of explanation is your chance to answer any questions a lender might have about your loan application This can range from a gap in your A letter of explanation sometimes called an LOE or LOW is a document requested by mortgage lenders when they want more details about your financial situation An underwriter may request a letter of explanation if they run into questions about your finances during the mortgage approval process Why do lenders ask for a letter of explanation

Letter Of Explanation For Buying Second Home Sample

Letter Of Explanation For Buying Second Home Sample

https://www.typecalendar.com/wp-content/uploads/2023/05/letter-of-explanation-mortgage-template-word.jpg?gid=453

35 Sample Letter Of Explanation For Buying Second Home Hamiltonplastering

https://hamiltonplastering.com/wp-content/uploads/2019/05/sample-letter-of-explanation-for-buying-second-home-best-of-sample-letter-of-intent-to-purchase-9-documents-in-pdf-of-sample-letter-of-explanation-for-buying-second-home.jpg

Sample Letter Of Explanation For Buying Second Home Inspirational Here

https://i.pinimg.com/originals/d0/06/63/d00663f06eacd03e8e5c802ed9fe22dc.jpg

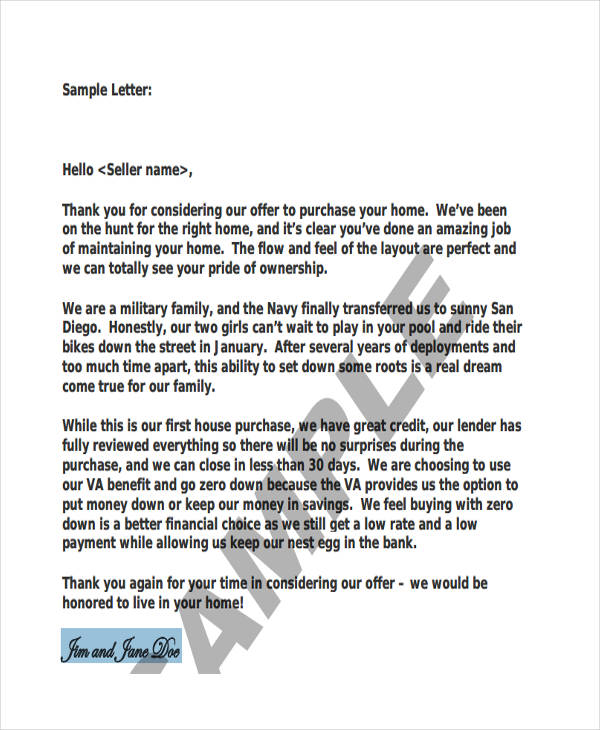

Letter of Explanation for a Mortgage Template and How To Write One If your lender flags a portion of your mortgage application you might need to draft a letter of explanation to move forward with the homebuying process To write an intent to occupy letter you should include your name the home s address your decision to apply for a mortgage and your intent to occupy the home as the owner You should also include any specific details that your lender requests

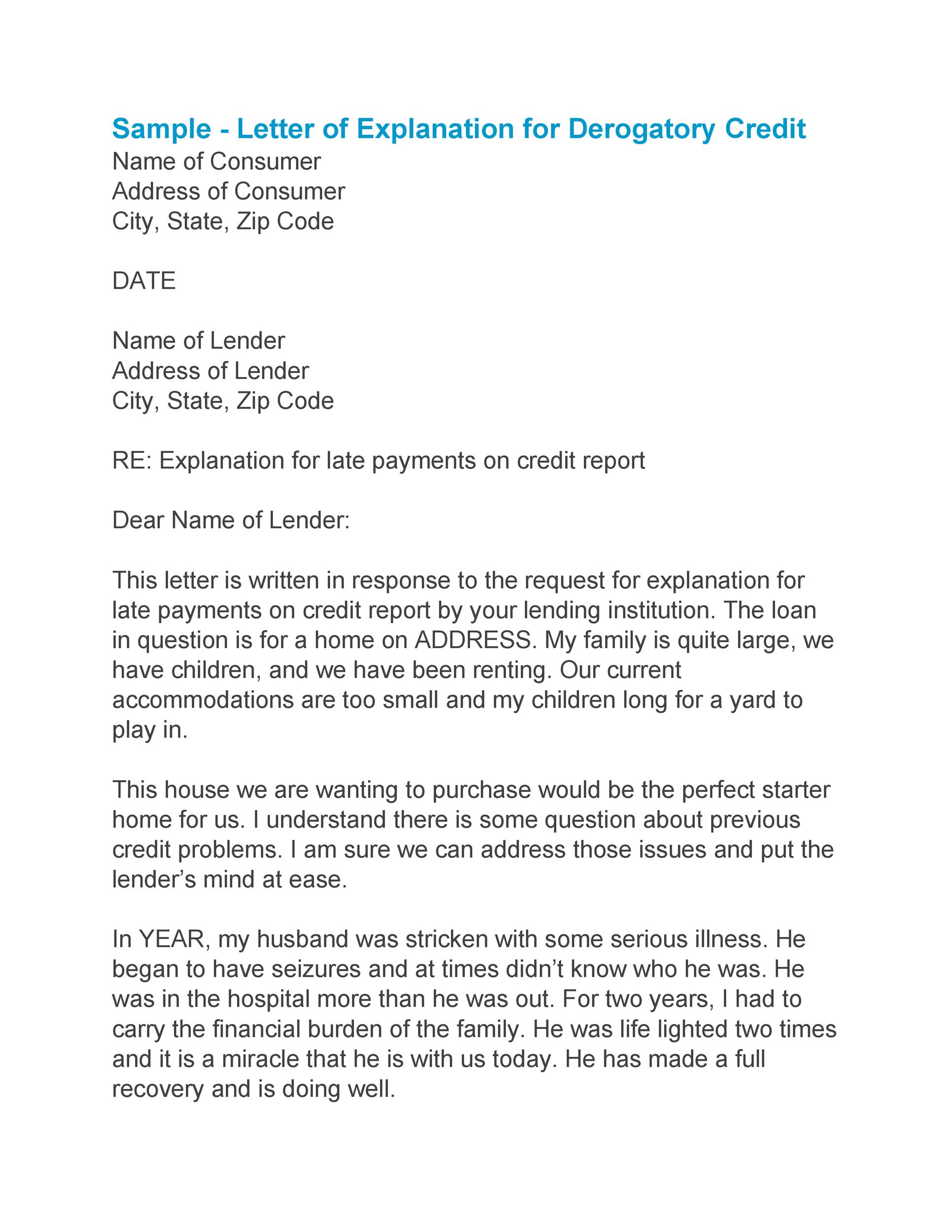

Letters of explanation are particularly useful in situations where an underwriter might have concerns during the loan or mortgage application process It serves to address issues such as past bankruptcies or gaps in employment ensuring a transparent and comprehensive understanding of the applicant s financial standing Date the letter is being written Lender s name mailing address and phone number Loan number Subject line should read RE Your name loan number Body should explain the issue and include specific details such as names dollar amounts dates account numbers and other clarification as requested

More picture related to Letter Of Explanation For Buying Second Home Sample

A Letter To Someone Requesting That They Are Leaving The Office

https://i.pinimg.com/originals/1e/74/8e/1e748e7db8d15591b693646dc6e94e4f.jpg

42 Sample Letter To Homeowners Asking To Sell Contoh Surat

https://images.template.net/wp-content/uploads/2017/04/20035534/House-Sale-Offer-Letter1.jpg

35 Sample Letter Of Explanation For Buying Second Home Hamiltonplastering

https://hamiltonplastering.com/wp-content/uploads/2019/05/sample-letter-of-explanation-for-buying-second-home-best-of-hardship-letter-loan-modification-of-sample-letter-of-explanation-for-buying-second-home.jpg

Key takeaways A letter of explanation for a mortgage is a document that provides further details about a borrower s credit or financial circumstances The letter of explanation might A letter of explanation LOE or LOX is a letter you draft in response to a mortgage lender s request to explain ambiguous or derogatory information in your credit history income background or other application documentation When submitting your initial mortgage application an LOE is an opportunity to explain your situation

How to write a letter of explanation Let s break down a sample letter of explanation with the primary components highlighted in bold You can use this as an example format to write your own letter You want to keep your letter professional and to the point Though when warranted you do want to go into detail about your situation A Letter of Explanation often called an LOE pronounced el oh EE is a way for home buyers to clarify aspects of their mortgage application that may not be clear to a lender Lenders request the buyers write a letter of explanation whenever there s unusual or unclear information in the context of the mortgage application including

48 Letters Of Explanation Templates Mortgage Derogatory Credit

http://templatelab.com/wp-content/uploads/2019/01/letter-of-explanation-26.jpg?w=790

Sample Letter Of Explanation For Buying Second Home New Yellow Letter

https://i.pinimg.com/originals/0b/8b/0d/0b8b0d2cbc6a669eca7d1fcd57e173c4.jpg

Letter Of Explanation For Buying Second Home Sample - Letters of explanation are particularly useful in situations where an underwriter might have concerns during the loan or mortgage application process It serves to address issues such as past bankruptcies or gaps in employment ensuring a transparent and comprehensive understanding of the applicant s financial standing