Hard Inquiry Removal Letter Pdf Step 1 Check Your Credit Report Obtain a free report from major credit bureaus Identify the hard inquiries you wish to dispute Step 2 Identify Inquiries for Dispute Focus on inquiries that were not authorized by you Step 3 Gather Necessary Information Collect details like the date of the inquiry and the company name

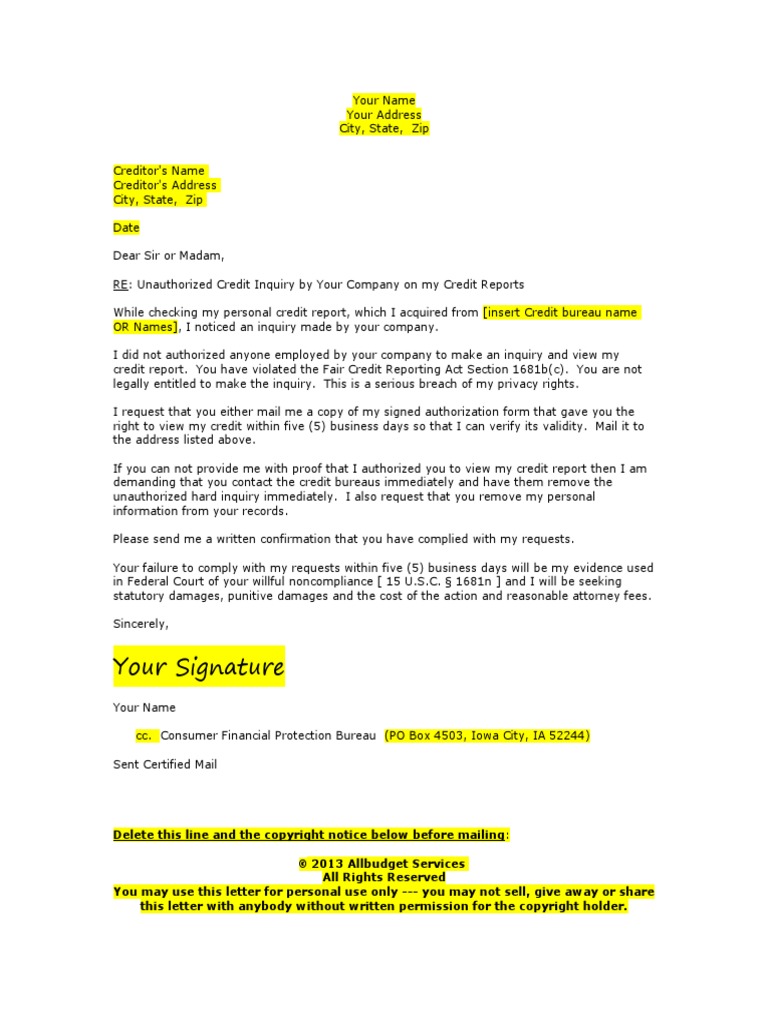

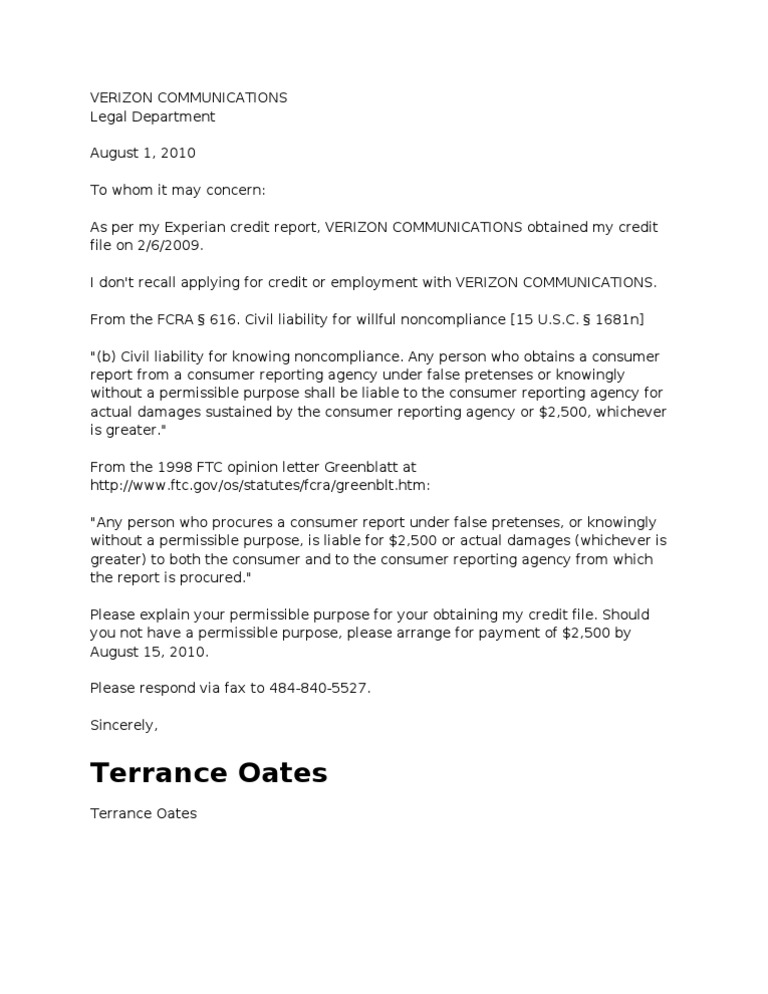

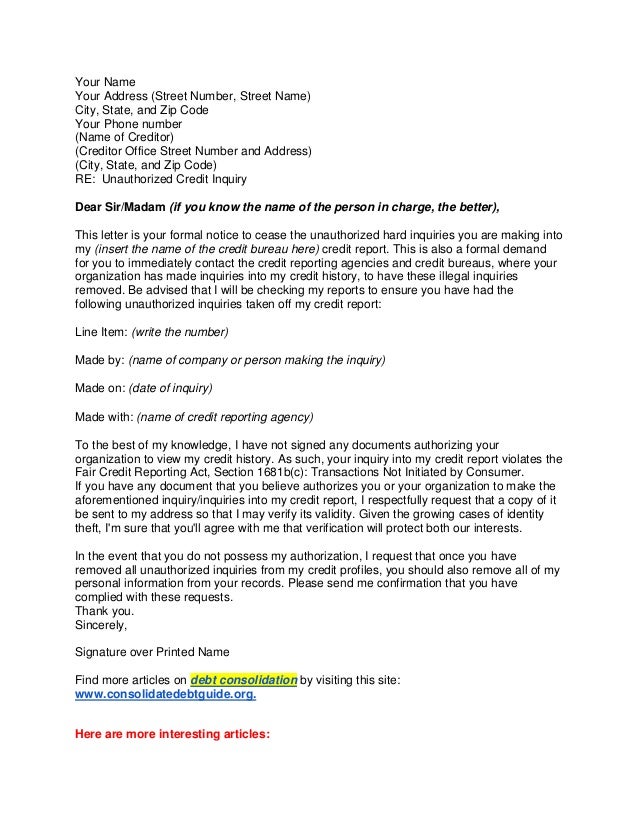

A credit inquiry removal letter is used to dispute an unauthorized inquiry It is sent to the credit bureaus to request that a credit inquiry be removed After receiving your letter the credit bureaus are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report LETTER report dispute This guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete and you would like to submit a dispute of that information to the credit reporting company

Hard Inquiry Removal Letter Pdf

Hard Inquiry Removal Letter Pdf

https://mlsjoxwh2dv5.i.optimole.com/cb:fJ2b~7176/w:791/h:1024/q:90/f:avif/https://finmasters.com/wp-content/uploads/2022/11/Credit-Inquiry-Removal-Letter.jpg

Sample Hard Inquiry Dispute Letter

https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-04.jpg

FREE 18 Sample Letter Of Credit In PDF Word

https://images.sampletemplates.com/wp-content/uploads/2016/04/13130125/Credit-Inquiry-Removal-Letter.jpg

A credit inquiry removal letter is a tool that you ll use to remove an unauthorized hard inquiry on your credit report This letter requests the credit bureau to remove the inquiry asserting that it was not authorized by you A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed Upon receipt it is the credit bureaus duty to investigate your claim with the information provider and make a decision about whether it should remain or be deleted from your credit report

Applications are considered hard inquiries and it is a result of an application for an auto loan home mortgage or credit If you have applied for these you will have an inquiry on the credit report Whenever you make an application the lender will run a check on the credit and it will appear on the report Updated May 19 2023 4 min read In a Nutshell Too many hard inquiries can hurt your credit but you can request to remove hard inquiries that are inaccurate Here s how to dispute hard inquiries that shouldn t be on your credit reports

More picture related to Hard Inquiry Removal Letter Pdf

Letter Of Explanation For Credit Inquiries Template Awesome Letter

https://i.pinimg.com/736x/b1/f6/11/b1f611c78c4771850282082b3ac39cce.jpg

Sample Letter Of Inquiry Download Printable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/2129/21295/2129573/sample-letter-of-inquiry_print_big.png

Hard Inquiry Removal Letter

https://imgv2-2-f.scribdassets.com/img/document/355716204/original/b3ea80982d/1566326673?v=1

What is a Hard Inquiry Hard inquiries such as those made by credit card companies mortgage companies and other similar institutions can have serious effects on your credit score These types of inquiries stay on your report for two years but usually only affect your credit score for the first year Once you submit the request you can track your progress through the Dispute Center Generally the dispute process will be done within 30 days If the inquiry was found to be valid it will not be removed from your credit report However if the investigation shows the inquiry was a result of identity theft it will be removed from your report

What is a hard inquiry section 604 dispute letter Section 604 refers to the Fair Credit Reporting Act which says a hard inquiry can only be performed with a permissible purpose This purpose typically requires explicit permission from you the consumer Template 3 Disputing Hard Inquiries Made During the COVID 19 Pandemic I am writing to dispute the following hard credit inquiries on my credit report These hard inquiries were made during the COVID 19 pandemic and I believe they may be the result of unauthorized activities or errors caused by the pandemic s economic impact

Hard Inquiry Removal Letter Printable

https://imgv2-1-f.scribdassets.com/img/document/37823537/original/a2c32eba1a/1584738352?v=1

25 Remove Hard Inquiry Dispute Letter Cecilprax

http://image.slidesharecdn.com/sampleletterstoremoveinquiries-130611214105-phpapp02/95/sample-letters-to-remove-inquiries-2-638.jpg?cb=1370990960

Hard Inquiry Removal Letter Pdf - A credit inquiry removal letter is a tool that you ll use to remove an unauthorized hard inquiry on your credit report This letter requests the credit bureau to remove the inquiry asserting that it was not authorized by you