Bank Reconciliation Practice Problems During October the business recorded a debit to Salaries Expense for 271 and while crediting Cash in the amount of 25 The business s Cash account shows an August 31 balance of 2 285 Prepare the bank reconciliation at August 31 Journalize any transactions required from the bank reconciliation

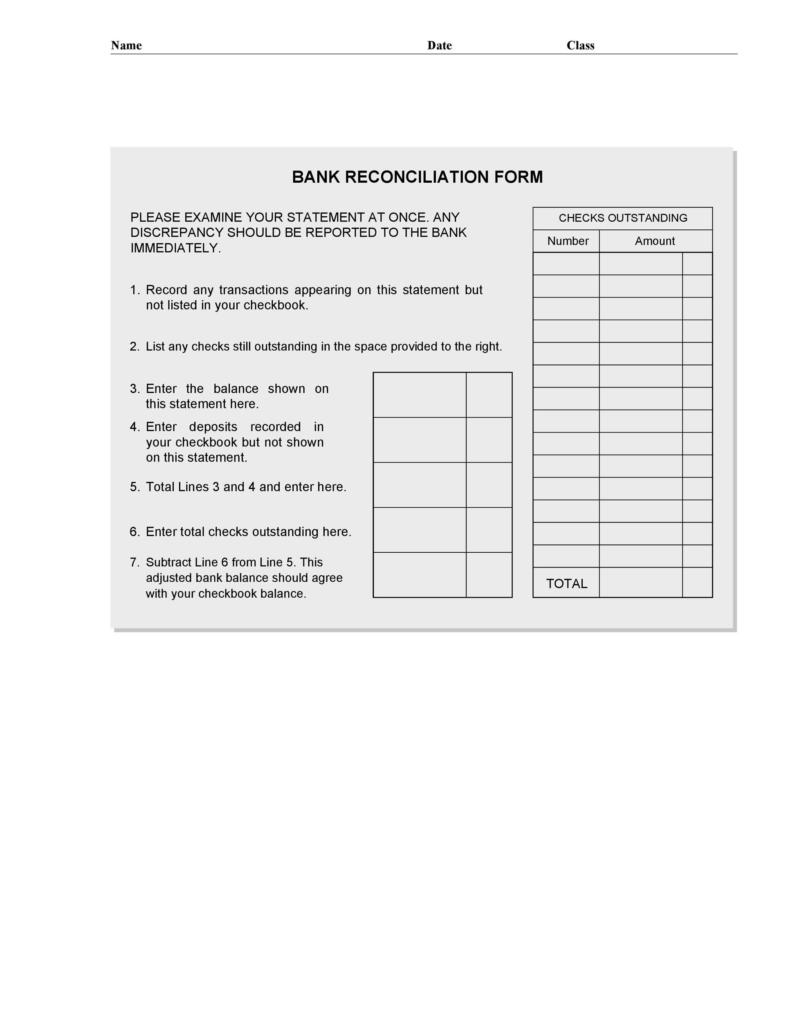

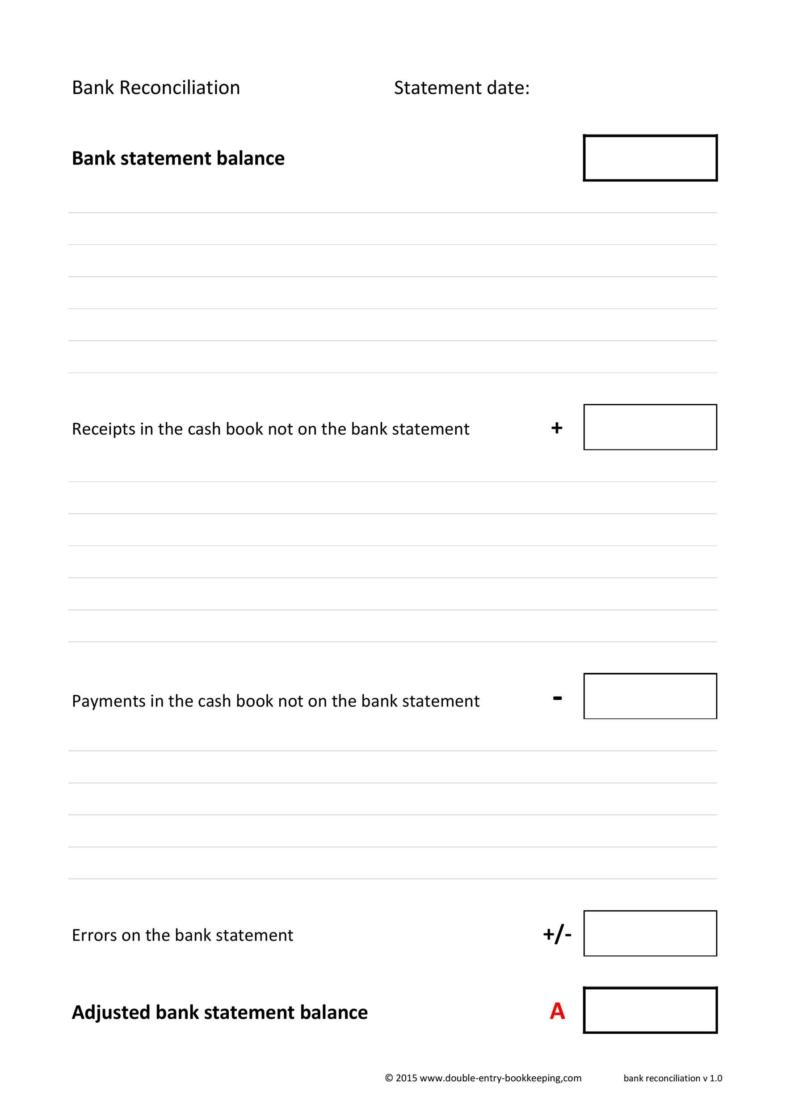

The first bank reconciliation exercise is a step by step tutorial see what to do at each step It brings to light common problems and the solutions to fix them You will learn How to match the transactions on the bank statement to the cash book How to make a note of any bank reconciliation problems What to do to solve the problems Introduction In the bank reconciliation process the transactions recorded in the company s electronic bank statements EBS or electronic cash book are compared with its e passbook or digital passbook cash book are compared with the bank s passbook to identify any inconsistencies in the day to day transactions

Bank Reconciliation Practice Problems

Bank Reconciliation Practice Problems

https://content.bartleby.com/tbms-images/9781337902663/Chapter-7/images/02663-7-22e-question-digital_image_001.png

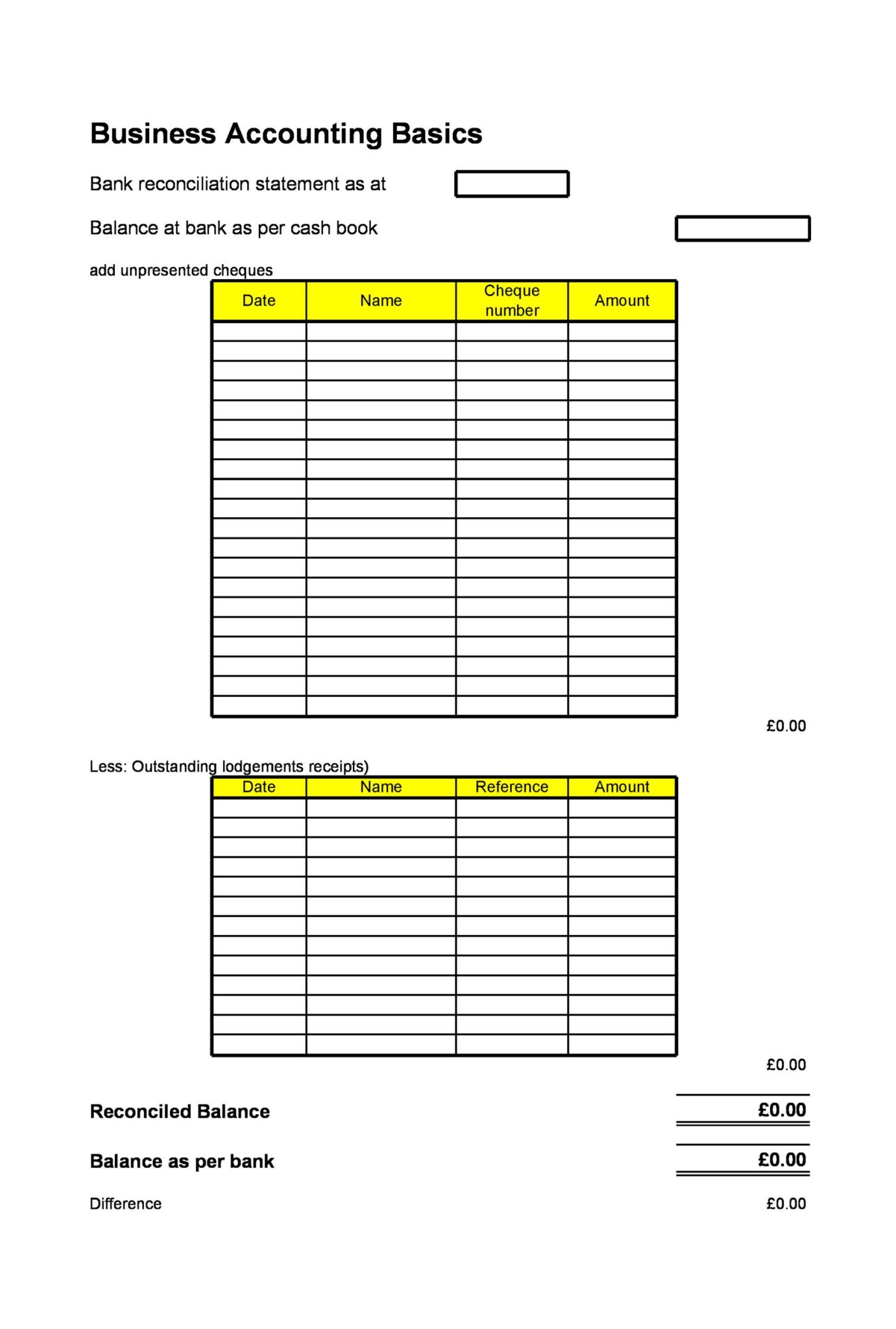

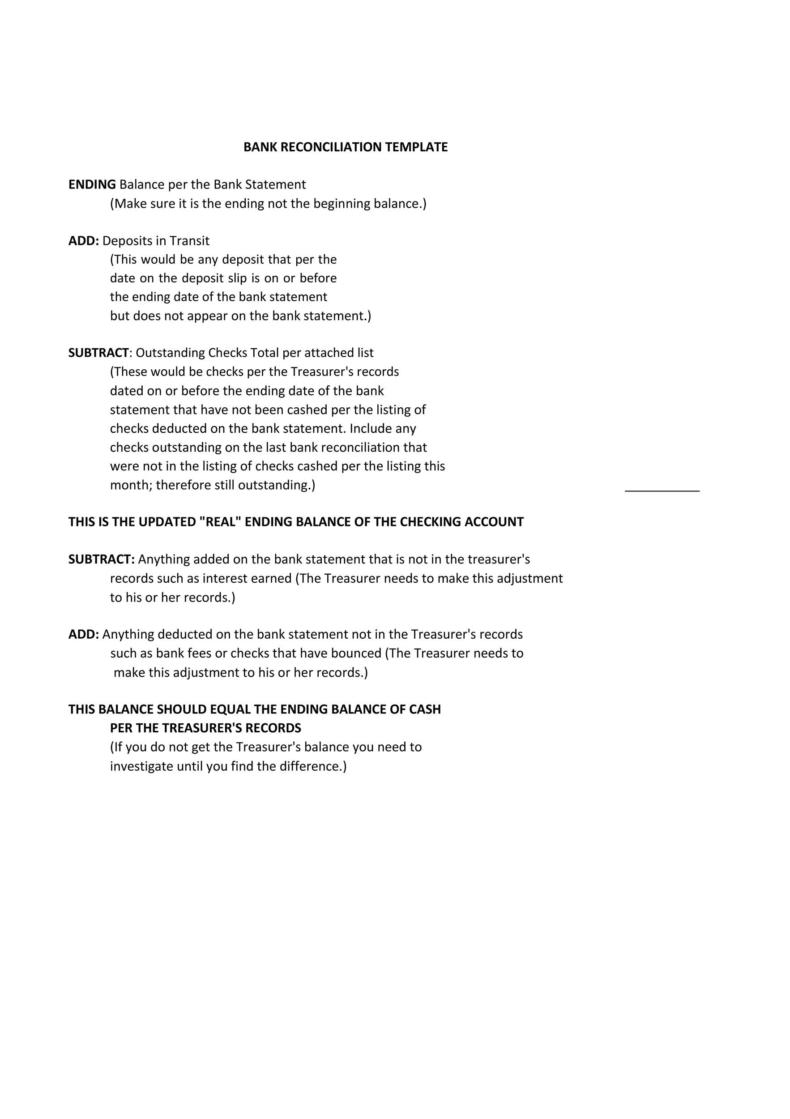

50 Bank Reconciliation Examples Templates 100 Free

https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-34-790x1022.jpg

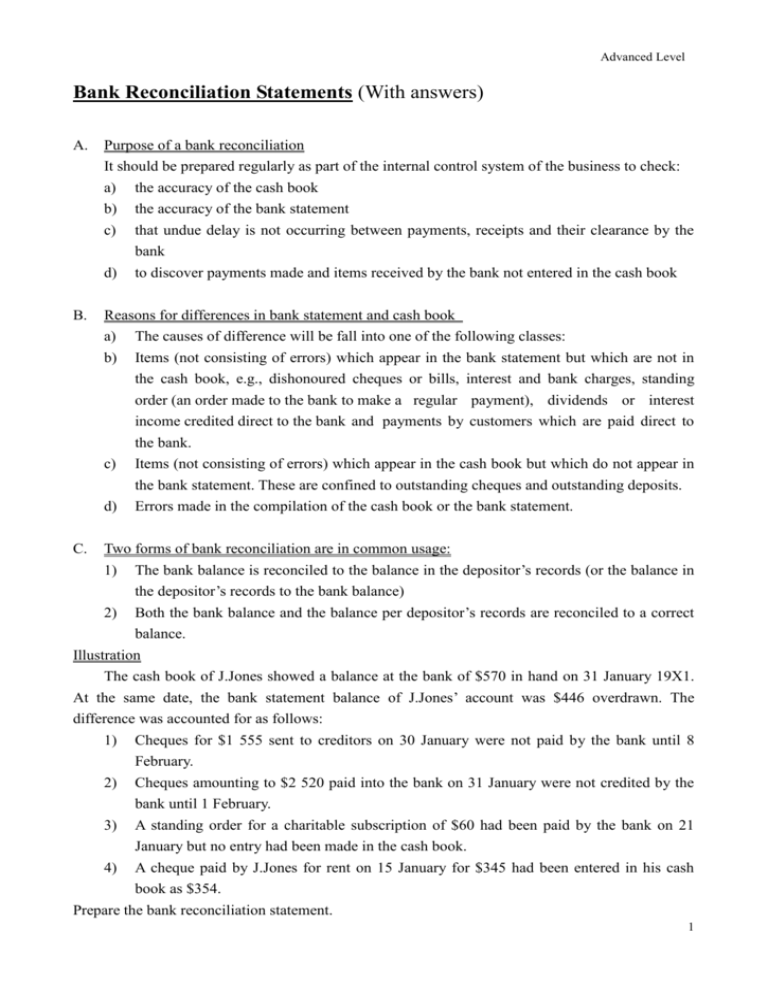

4 Bank Reconciliation Statement Problems Solution Example

https://cdn-resources.highradius.com/resources/wp-content/uploads/2022/05/Real-Life-Problems-Of-Bank-Reconciliations_img2.png

Problem 1 From the following particulars prepare a Bank Reconciliation Statement to find out the causes of difference in two balances as on August 31 st 2016 for Four Star Pvt Ltd i Bank Overdraft as per Bank Statement 17 000 ii Check issued but not encashed during the August 2 200 Bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections In the case of personal bank accounts

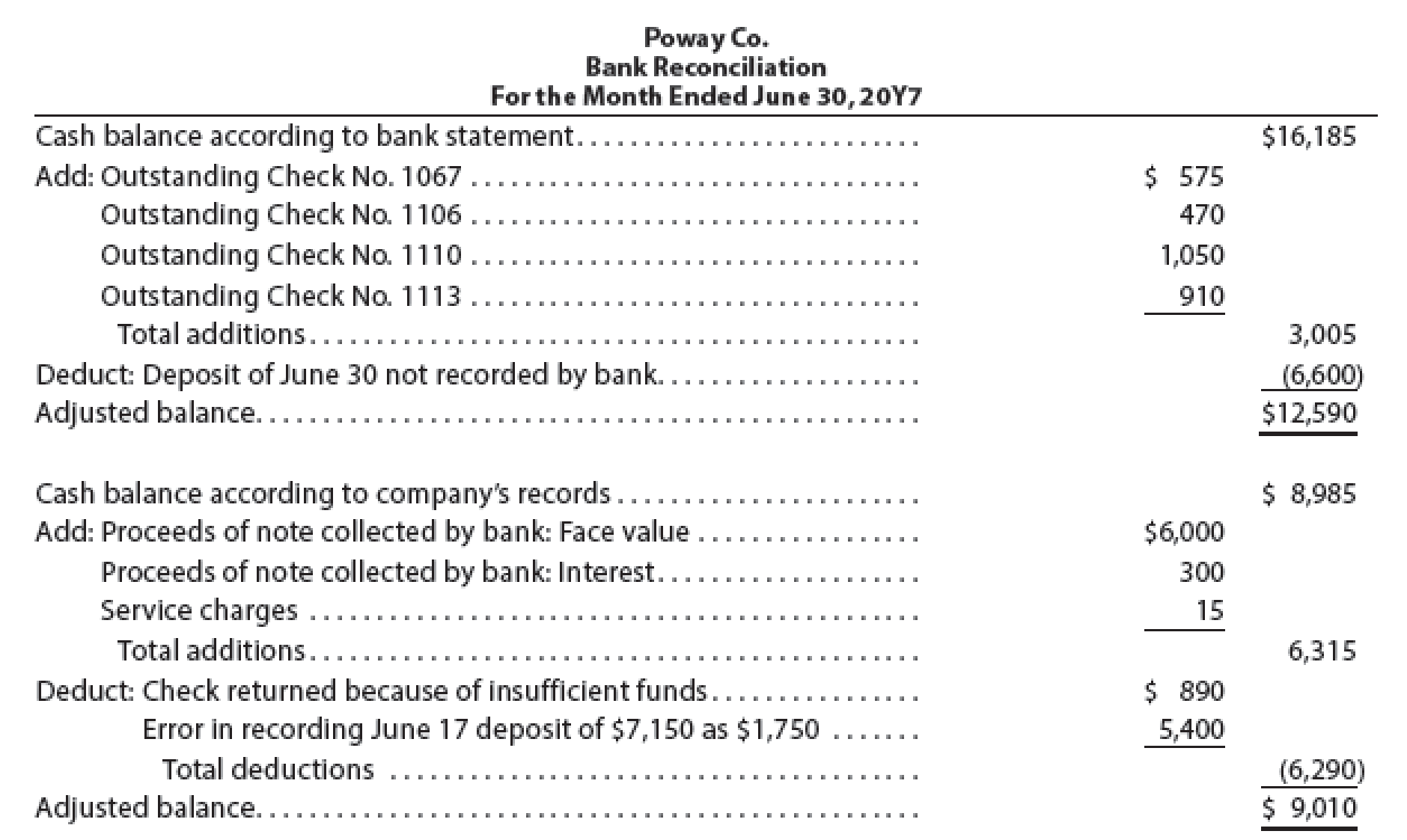

A bank reconciliation statement is a document that compares the cash balance on a company s balance sheet to the corresponding amount on its bank statement Reconciling the two accounts helps identify whether accounting changes are needed Bank reconciliations are completed at regular intervals to ensure that the company s cash records are correct Accounting Coach This is another thorough scenario with a fictitious bank account to reconcile The explanations of how to reconcile are clear and the exercise takes it one step further by

More picture related to Bank Reconciliation Practice Problems

Bank Reconciliation Statements With Answers

https://s3.studylib.net/store/data/008445071_1-b3a525f0c964bf3c136444adc3c0b1de-768x994.png

50 Bank Reconciliation Examples Templates 100 Free

https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-25-790x1117.jpg

55 Useful Bank Reconciliation Template RedlineSP

https://www.redlinesp.net/wp-content/uploads/2020/08/Bank-Reconciliation-Template-13-1381x2048.jpg

29 2 concept Bank Reconciliation Book Column 5m 0 Comments Mark as completed Was this helpful 22 3 Problem A company has a current balance in its Cash account of 3 400 The bank statement arrived showing a bank balance of 5 900 Prepare the cash reconciliation noting the following events Deposits in transit total 600 2 Bank Reconciliation in Chapter 6 Problem 2 of 2 Hard The treasurer of a company was preparing a bank reconciliation as of March 31 The following items were identified The balance per books was 9 600 Interest earned on the checking account during March was 10 Outstanding checks totaled 875

Bank Reconciliation Problems The purpose behind preparing the bank reconciliation statement is to reconcile the difference between the balance as per the cash book and the balance as per the passbook However in practice there exist differences between the two balances and we need to identify the underlying reasons for such differences Bank reconciliation is an important process in business and banking and this quiz worksheet will help you test your understanding of its definition and related terms Quiz Worksheet Goals

50 Bank Reconciliation Examples Templates 100 Free

https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-28-790x1119.jpg

Bank Reconciliation Practice Problems Pdf Important Class 11

https://jkbhardwaj.com/wp-content/uploads/2021/07/Screenshot-173.png

Bank Reconciliation Practice Problems - Problem 1 From the following particulars prepare a Bank Reconciliation Statement to find out the causes of difference in two balances as on August 31 st 2016 for Four Star Pvt Ltd i Bank Overdraft as per Bank Statement 17 000 ii Check issued but not encashed during the August 2 200