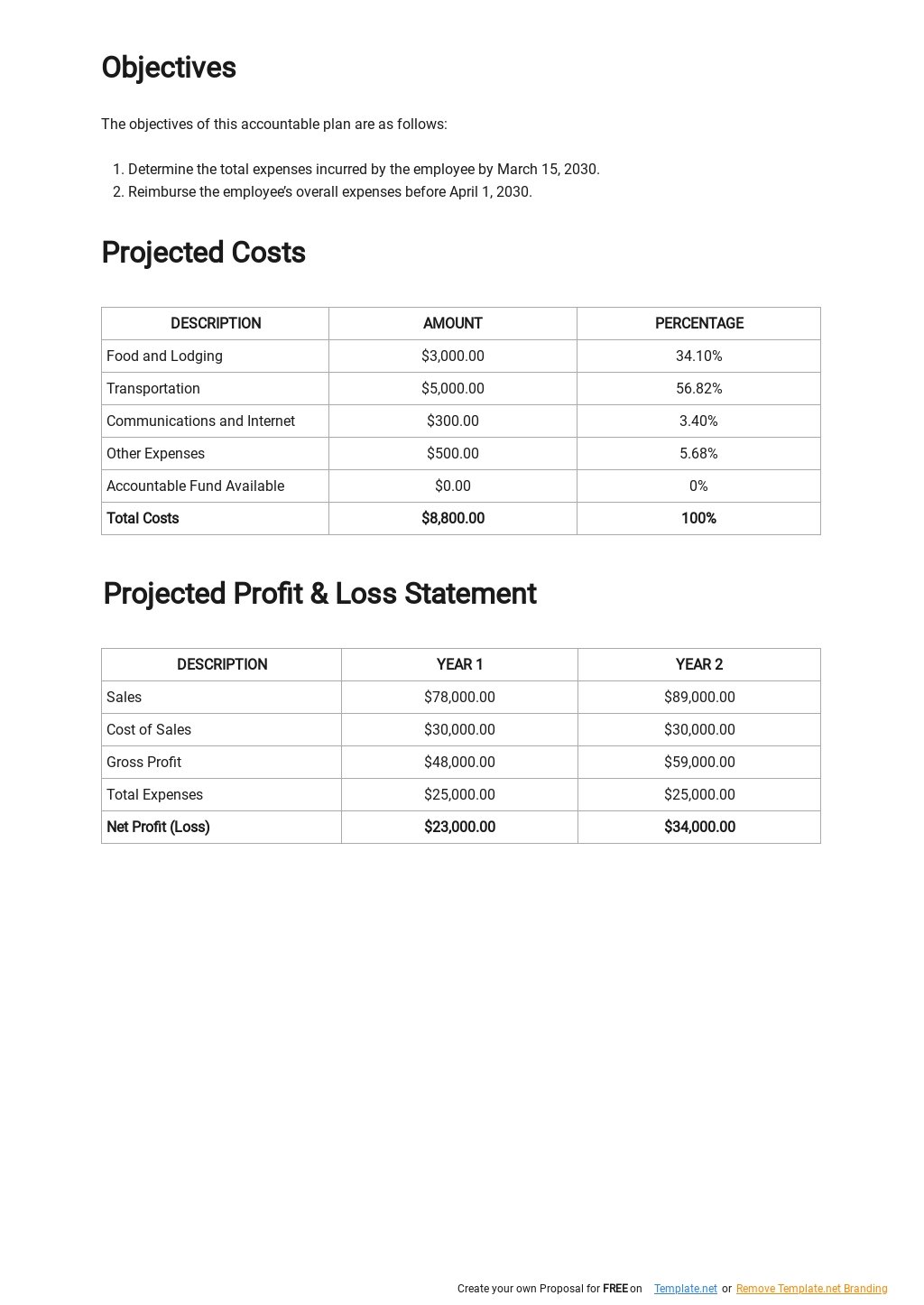

Accountable Plan Template Excel ACCOUNTABLE PLAN desires to establish an expense reimbursement policy pursuant to Reg 1 62 2 upon the following terms and conditions Except as otherwise noted in Part II below any person now or hereafter employed by shall be reimbursed for any ordinary and necessary business and professional expenses incurred on behalf of only if the

Sample Accountable Plan for Business Expense Reimbursement Purpose This document can be used as a guide to draft an accountable plan for expense reimbursements However it is merely an example and it is not meant to be adopted or adapted without consulting appropriate legal counsel FREE Accountable Plan Template Download in Word Google Docs Excel PDF Google Sheets Apple Pages Plan Presentation Personal Financial Plan Essay Plan Personal Development Plan Pandemic Plan New Business Plan Business Plan Accountable Plan Templates

Accountable Plan Template Excel

Accountable Plan Template Excel

https://images.template.net/62889/Accountable-Plan-Template-1.jpeg

Accountable Plan Template Excel

https://i.ytimg.com/vi/5N-JK7G7gW0/maxresdefault.jpg

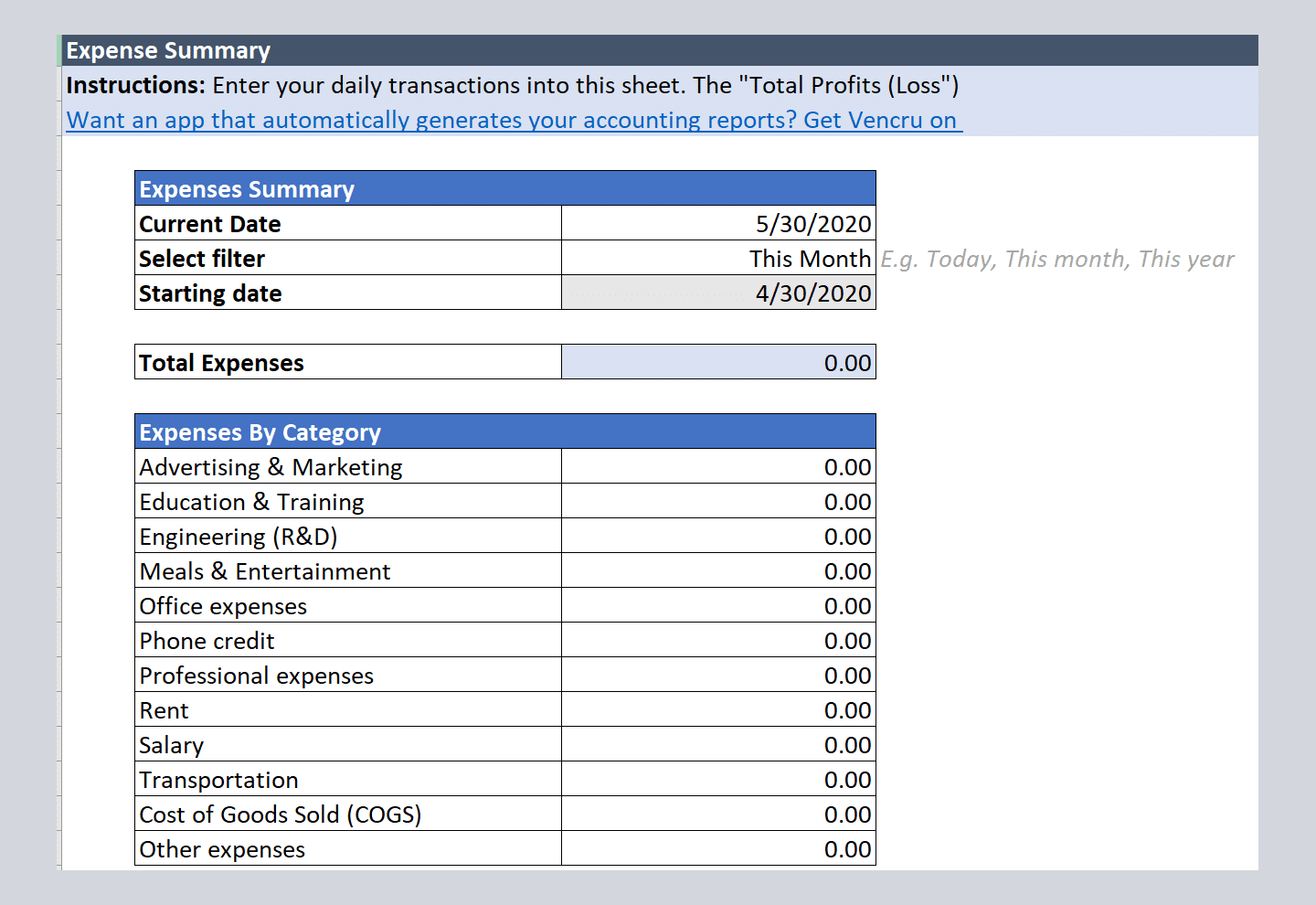

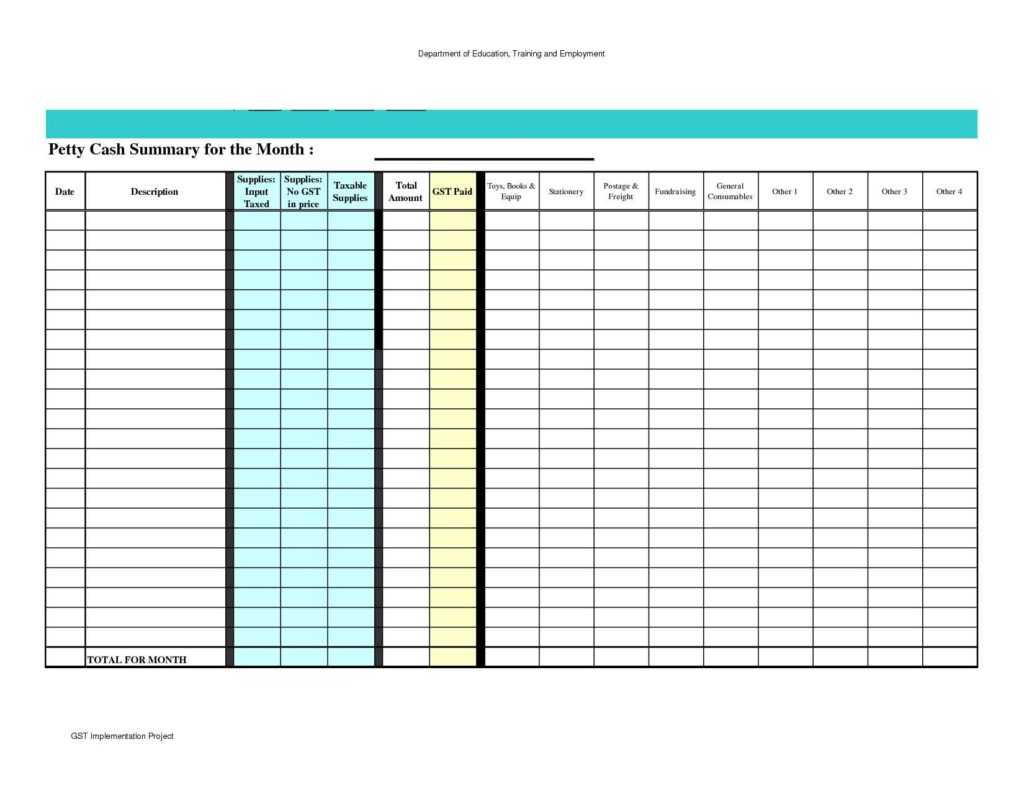

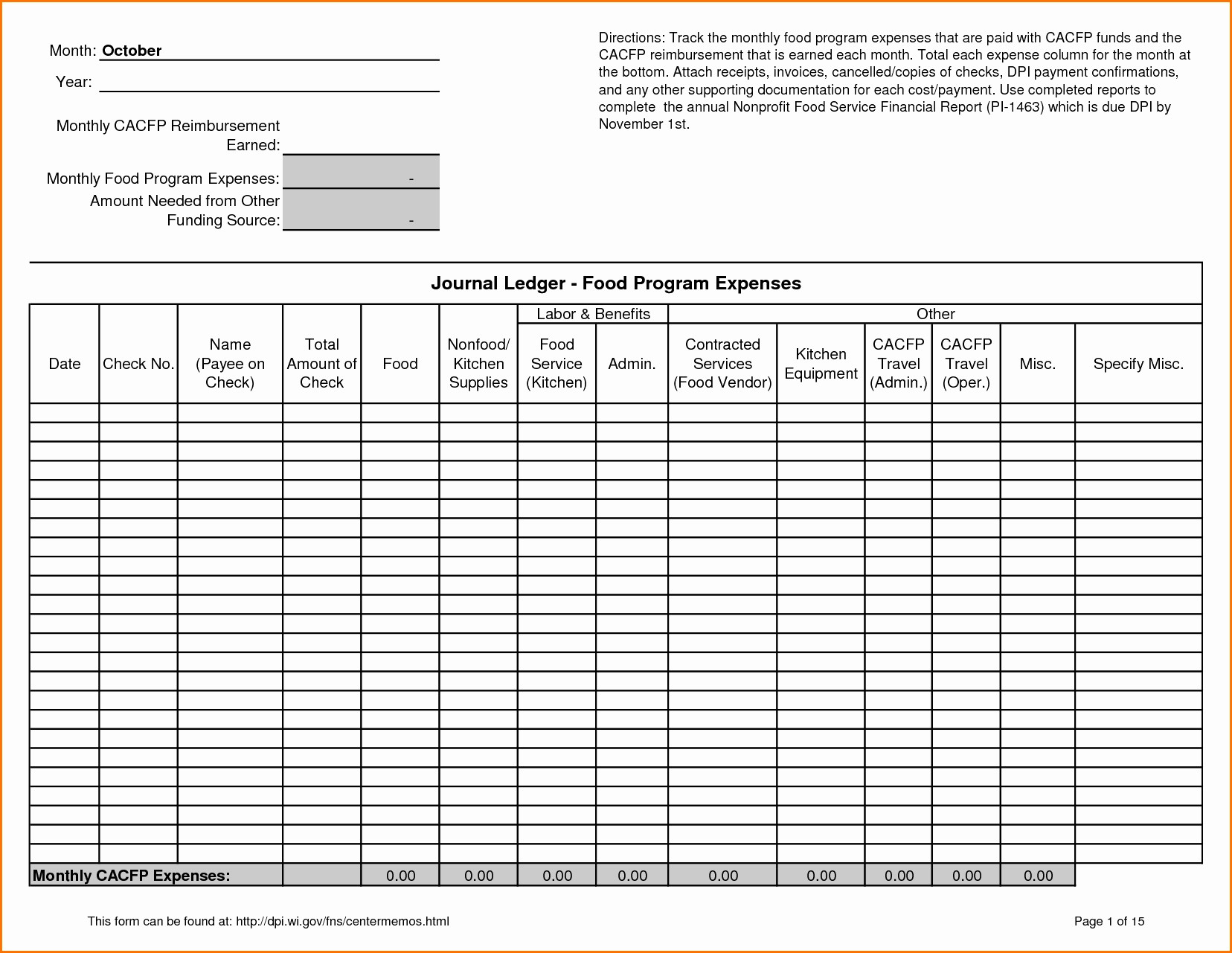

Free Excel Accounting Templates And Bookkeeping Spreadsheet Vencru

https://vencru.com/wp-content/uploads/2020/08/20200726_Expenses_template_v01.png

Accountable Plan Form xlsx Expense Reimbursement Spreadsheet Employee Date Period From To Home Office A home office qualifies as your principal place of business if you use it exclusively and regularly for administrative activities and you have no other fixed location where you do so This reimbursement form was designed to allow employees to request reimbursement for general business expenses For travel related expense reimbursement use the Travel Expense Report If you routinely use a vehicle for business purposes download our Mileage Tracking Log related blog articles How Do I Reimburse an Employee For Business Expenses

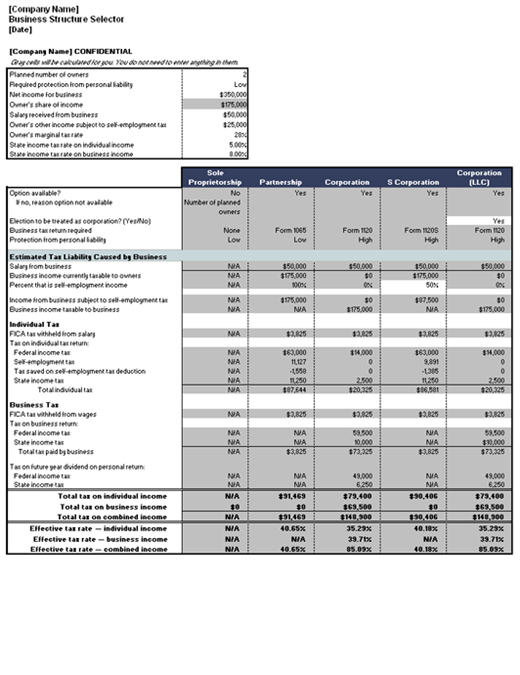

To offer an accountable plan an employer must comply with three standards The expenses must have a business connection The expenses must be substantiated within a reasonable period and The employee must return any money not spent to the employer also within a reasonable period If any of the three conditions isn t met the reimbursement Grab the Accountable Plan Template Here Now let s talk about it in English An accountable plan allows you to reimburse employees for work related costs including yourself They are not subject to taxation by your employees but are 100 deductible for you They must be business related and reported using an expense report

More picture related to Accountable Plan Template Excel

Accountable Plan Template Excel

https://omextemplates.content.office.net/support/templates/en-us/lt10016353.png

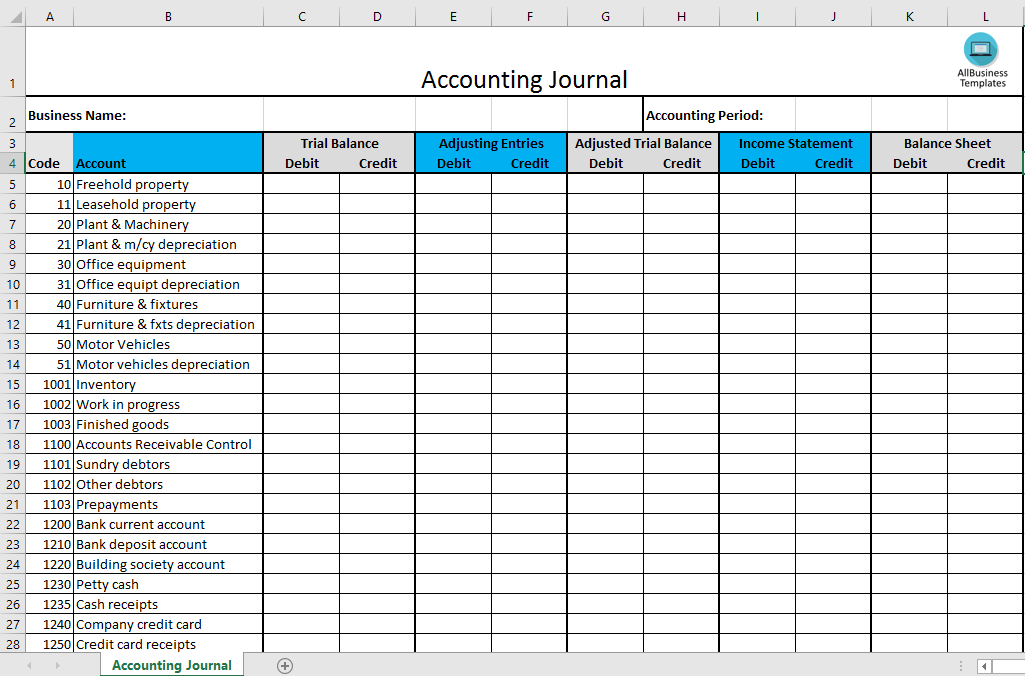

Top 13 Accounting Excel Templates Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/423092a4-53cc-4a50-b5f9-6a9b0191aadf.png

Accounting Spreadsheet Templates Excel Db excel

https://db-excel.com/wp-content/uploads/2017/07/accounting-balance-sheet-excel-template1.jpg

Free Excel Expense Report Templates Try Smartsheet for Free By Andy Marker December 13 2022 We ve gathered the top expense report templates for Excel and included tips on how to use them Fill out and submit these forms to your financial team to reimburse employees and to track deductions for your organization s taxes An accountable plan allows an employer to reimburse employees on a non taxable basis when certain requirements are met Accountable plan rules are detailed in Section 62 c of the Internal Revenue Code Publication 5137 Fringe Benefit Guide contains helpful information related to this topic The following three requirements under Treasury

An accountable plan is an expense reimbursement arrangement that requires employees to document their expenses and return any they cannot support Most payments made by an accountable plan do not count as wage income for the employee or generate payroll tax liability for the business Treasury Regulation 1 62 2 establishes a three part test to PART I ACCOUNTABLE PLAN desires to establish an expense reimbursement policy pursuant to Reg 1 62 2 upon the following terms and conditions Except as otherwise noted in Part II below any person now or hereafter employed by shall be reimbursed for any ordinary and necessary business and professional expenses incurred on

EXCEL Of Light Blue Accounts Receivable And Accounts Payable Form xls

https://newdocer.cache.wpscdn.com/photo/20190820/d4028905d7c04282a0debf4fc389780c.jpg

Accountable Plan Template Excel

https://db-excel.com/wp-content/uploads/2019/01/accounts-payable-spreadsheet-for-accounts-payable-spreadsheet-template-of-receiving-and-editing.jpg

Accountable Plan Template Excel - To offer an accountable plan an employer must comply with three standards The expenses must have a business connection The expenses must be substantiated within a reasonable period and The employee must return any money not spent to the employer also within a reasonable period If any of the three conditions isn t met the reimbursement